Hi Debbie,

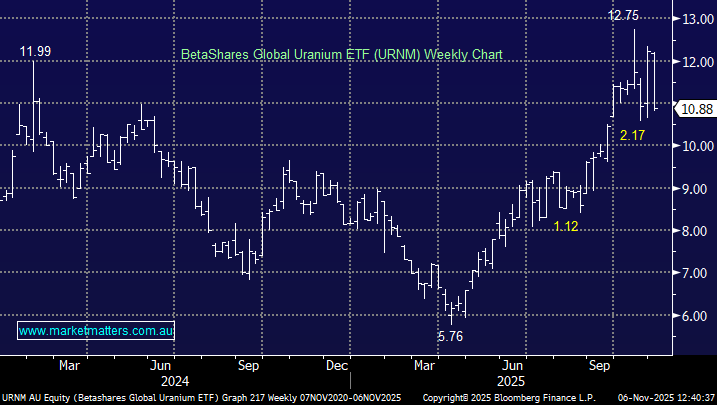

Uranium stocks have corrected in a very similar manner to the likes of gold, rare earths, lithium and even copper names over recent weeks, albeit to greater or less degree. We don’t believe the move is anything more sinister than a sector that more than doubled in 6-8 months taking a breather. We remain bullish on the demand thematic around uranium and nuclear power as governments strive to satisfy the future energy demands from AI.

- In terms converting of thorium to uranium, we’ve deferred to Shawn with his Chemical Engineering background, and his initial comment was “good luck with that in my lifetime”.

You cannot “convert thorium to uranium” directly, but you can breed uranium-233 from thorium in a reactor. This is the objective behind thorium fuel cycle reactors, which aim to use relatively abundant thorium to create usable nuclear fuel more safely and efficiently than traditional uranium cycles. At this stage uranium remains far cheaper and better supported by global infrastructure.

Thorium is about 3× more abundant than uranium, produces less long-lived waste, and is resistant to weaponisation. Hence countries such as India, China, and Norway continue R&D for strategic and environmental reasons, more so than just near-term profit. China has a prototype which is running, but commercial use is still years away with a 100 MW goal by 2035 ambitious at best.

- The more expensive uranium becomes the more money will be poured into ongoing R&D but we don’t believe it has had any influence on recent moves.