Hi Debbie.

Two very different but extremely topical areas which have some overlap with MM’s Alerts on Friday:

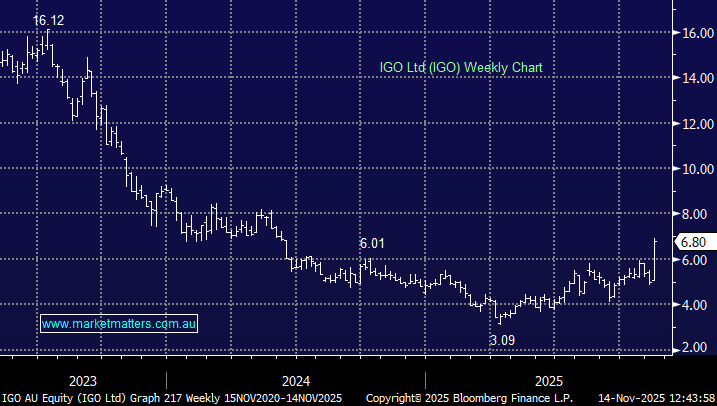

IGO Ltd (IGO) – we like the leverage in this lithium/nickel play that has been in the doldrums for the last two years. IGO’s lithium operations, including the Greenbushes mine and the Kwinana refinery, remain active, albeit facing some operational challenges. These two interests offer significant upside potential if lithium prices recover meaningfully above $ US$1,000, with its Greenbushes operation being among the most cost-effective lithium producers globally.

The dramatic change in sentiment over the last week could see IGO test $8, but it’s already scaled our initial $6.50 target this week. We trimmed our MIN position on Friday after it led the lithium charge on Wednesday, following its deal with POSCO – we still like the stock, but after +375% from its April low taking some profit made sense.

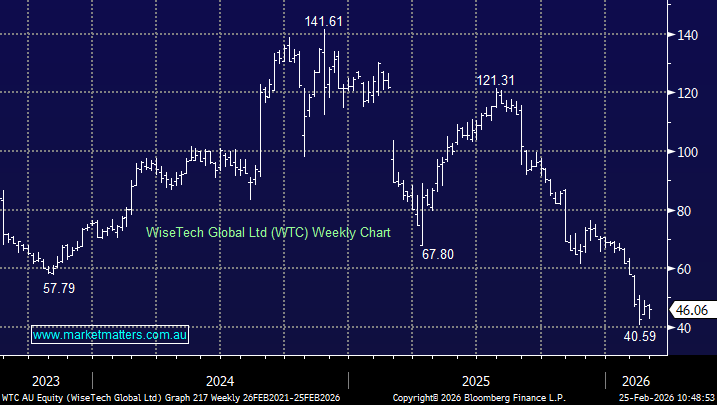

US Tech: Thursday nights 2% drop by the NASDAQ did feel pretty grim but it’s still less than 5% below its all-time high going into Friday’s session, not bargain territory. A further ~4% pullback wouldn’t surprise with the current 25,000-area feeling like no man’s land at this stage.

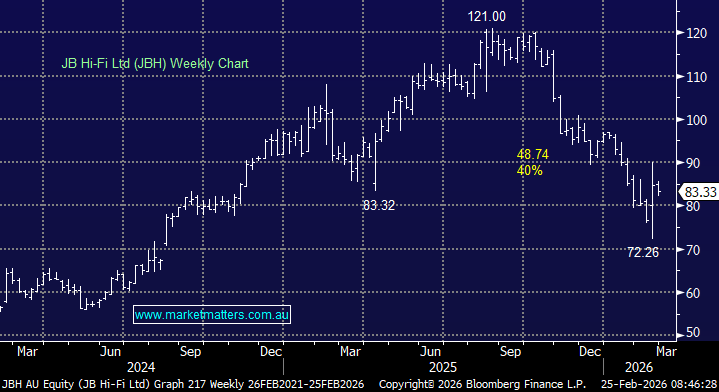

However, the local tech market has been hit far harder than its US cousin and we moved into “accumulation” mode on Friday re-entering CAR Group (CAR) after its 22% correction.

NB We are not saying we’ve seen the end to the outperformance by the resources over tech, but the elastic band is stretching.