Hi Debbie,

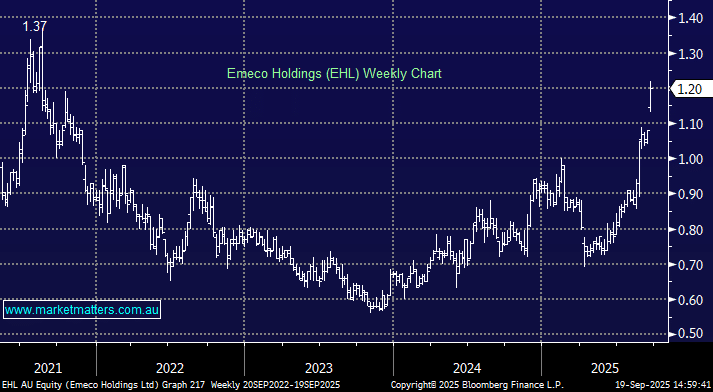

Emeco (EHL) -provides mining equipment rental, maintenance, and asset management services to mining companies in Australia, an exciting area if Chinas economy continues to gather momentum, albeit from a low base. However, as you say, all the activity this week has been around M&A talk but there has been no updates since Mondays announcement of “unsolicited acquisition interest from multiple parties”.

- We liked EHL’s FY25 numbers with its Net Profit of $75.1mn up 43% with the strong earnings likely to deliver significant free cash flow in FY26.

- EHL is ‘dirt cheap’ (still), trading on 6.8x earnings even after the run up. This sort of business does typically trade on a low multiple, but it’s easy to understand why other parties are running the ruler over EHL.

- If a bid (s) doesn’t materialise we see strong support ~$1.10, less than 10% below Fridays trade.

Hence, we still like the risk/reward towards EHL in the $1.20 area.

Suncorp (SUN) – insurance stocks have looked tired over the last month not helped because they traditionally prefer higher interest rates – not what the next 12-months is likely to deliver. Also the sector has being been a strong outperformer for the last 3-years leaving it vulnerable to some profit taking.

- This is not the optimum environment for insurers but we prefer QBE over SUN after its recent ~15% pullback.