Hi Debbie,

AIC Mines (A1M) – It’s been a frustrating year for this copper junior ($243mn) when heavyweight Sandfire (SFR) pushes to new highs. The issue is A1M is at the start of capital-intensive 18 months with growth in its capex forecast to be close to 40% by some analysts. Their goal is to lift Cu output by 7,000 tons by FY28. The stocks cheap if it’s successful but investors remain patient pre-empting too far in advance – we like it as a speculative play but it’s a guess when the market will consider re-rating the miner.

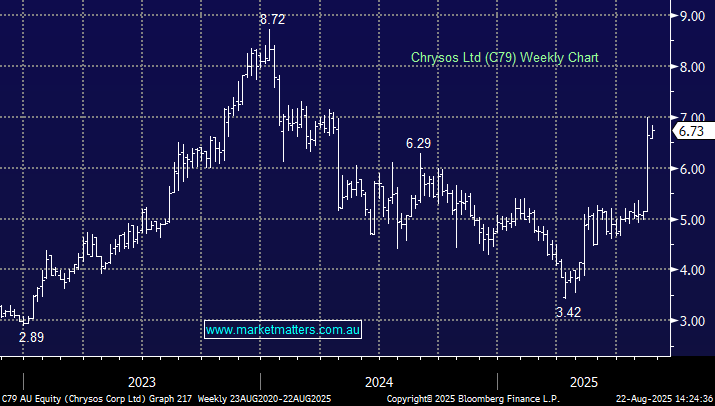

Chrysos (C79) – For subscribers not familiar with C79, it’s an Australian technology company that develops and commercialises PhotonAssay technology for the mining industry – a faster, safer, and more environmentally friendly alternative to traditional fire assay for measuring gold and other minerals in ore samples.

C79 has performed strongly in the last fortnight surging 35% after delivering an excellent result last week that saw Bells upgrade its PT for the stock by more than 50%! Revenue of $66.1mn was up 46% YoY, beating expectations while they forecasted FY26 revenue between $80-90mn. Strong cash flow, healthy balance sheet, and positive FY25 performance position means we the think company will easily meet its stated FY26 targets, with a good chance of beating them.

- We still like C79 even after its strong move.