Hi Nick,

Thanks for the thumbs up Nick, much appreciated!

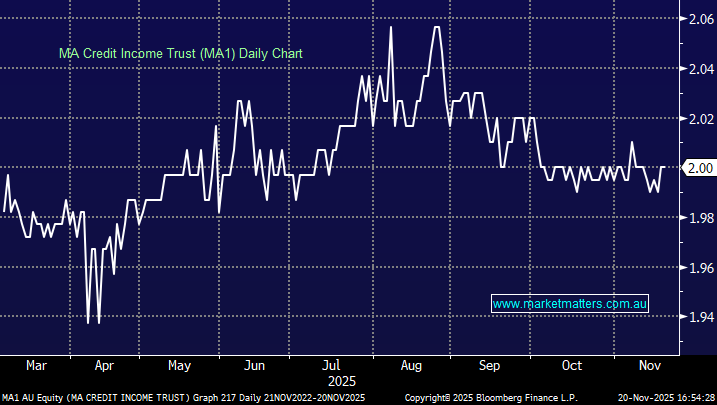

The MA2HA IPO is a new listed private credit note that will begin trading on the ASX on the 16th December, a similar structure to DMNHA. Livewire did a good interview with the manager recently – available here that outlines the difference between this new offer with the existing MA1 security issued by MA Financial. The MA2HA is a lower risk, lower return offer, no exposure to direct real-esatate, and no exposure to developers.

The key feature here is a 5% capital buffer funded by MA Financial – it sits in front of Noteholders and absorbs losses first, while also ensuring Noteholders are paid before any distributions flow to MA’s equity piece. If the buffer ever gets hit, all future equity distributions are diverted to top it back up—helping preserve stability of monthly income.

- Income: Monthly floating rate return of 1m BBSW + 3.25%

- Diversification: 90+ underlying credit positions with ~7 years’ history

- Alignment: MA Financial holds the equity and buffer pieces

- Proven track record: A similar unlisted strategy has hit its monthly target for 81 consecutive months while keeping its buffer intact

- Clear timeline: Call date in 2031 and final maturity in 2032, with a 1% margin step-up if not called

- Management fee of 0.90% – which is on the higher side. (DMNHA charge 0.5%)

Lonsec Research on the note available here.

In terms of on market trading, MA are good at supporting their issues. They have greater fire power than most to ensure solid on market performance. We’ve seen this recently with MA1. We think it will open at/around issue price.

They have raised $230m, and books closed Friday. We think this is a solid offer, from a good operator, though DMNHA trading ~$98 looks a bit more attractive.