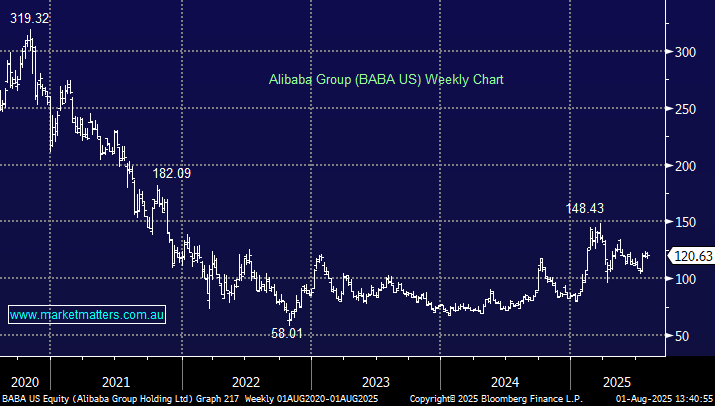

JD.com (JD US) and Alibaba (BABA US)

Hi James/Shawn can I please have your updated view on JD.com and Alibaba. Do you still believe JD is cheap? Is it fair to assume that of the 2 you are more bullish Baba with a 6% weighting vs JD which has a 4% position in your international portfolio. Both their share price has gone nowhere in last 6 months. It feels like I’m forever waiting for more stimulus to come out of China to get these stocks moving. Why else do you think these businesses are so out of favor as opposed to US Tech?