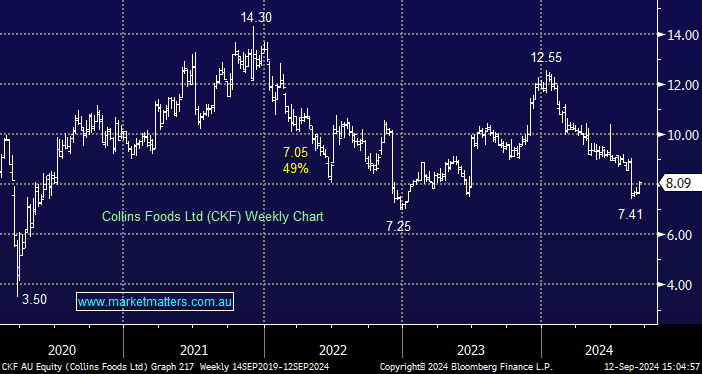

Is CKF (Collins Foods) a turnaround story and buy?

Hi MM, With CKF now down around the $8 mark, does it represent a turnaround story worth a buy? Yield is around 3.3% and the trading update so far for 1H 25 is bearish. However, with inflation dropping and rate cuts coming, plus new store openings. is the outlook for 2H25 & FY26 brighter? Thanks Peter