Hi Robert,

Like yourself we have been reading similar views and its one of the reasons along with plentiful supply and evolving processing methods that have seen MM adopt a cautious stance towards the Lithium (Li) space. Also, simple history tells us that new technologies often morph in directions unimaginable at the time, e.g. Lamborghini started out making tractors! Three MM investment scenarios around lithium have been influenced by this outlook:

- We continue to prefer BHP over RIO, especially since the latter bought Arcadium (LTM) and reiterated its intentions toward Li.

- Our lithium exposure in our Active Growth Portfolio, Minerals Resources, also has strong iron ore and mining services divisions.

- Liontown Resources (LTR) our lithium exposure in MM’s Emerging Companies Portfolio is a “situation play” since Gina amassed a major stake in the company.

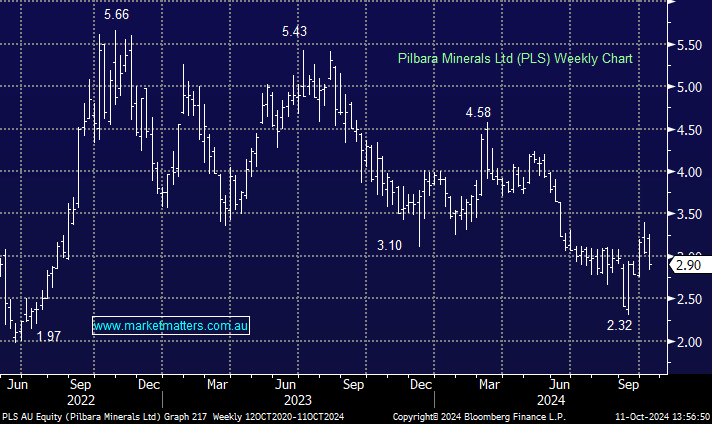

Pilbara Minerals (PLS) remains the most shorted stock in the ASX200 and we still believe it can test the $2 area, i.e. its a trading as opposed to investing thematic/stock for now. We have taken the above measures, simply because when and how batteries will be produced in the future is an open question at this stage – we simply don’t know for sure.