I’m confused by Hybrids

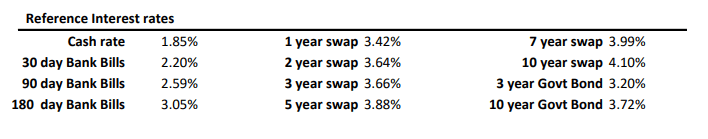

Hi Shawn I know I have rung you regarding Hybrids and the question was going to be put into the Saturday Q & A, hasn’t happened yet. Having had a another look at the Hybrids, I can’t get the rate that they say they are paying to equal that of the dividend. I can see it is the BBSW plus the rate. I have had look at BOQPE as an e.g. and their distribution is $1.0701 but that doesn’t come up to what I understand to be the rate. Has it got something to do with the tax (franking). Thanks & regards, Shane M