Hi Hylton,

We are already seeing changes coming into fossil fuels space moving forward with banks and underwriters starting to avoid the sector as it becomes increasingly unpopular, this by definition should support prices medium term as it reduced supply.

However if/when govt’s try and impose price caps its likely to be very messy with plenty of countries / regions prepared to pay more hence for it to have a negative impact on the Australian coal & gas companies the local government will need to cap the price that they sell their product across the board to have any meaningful impact, this would by definition be a headwind for the producers but by definition it hasn’t occurred yet which suggests higher prices are required to trigger such a move which is at least bullish for now.

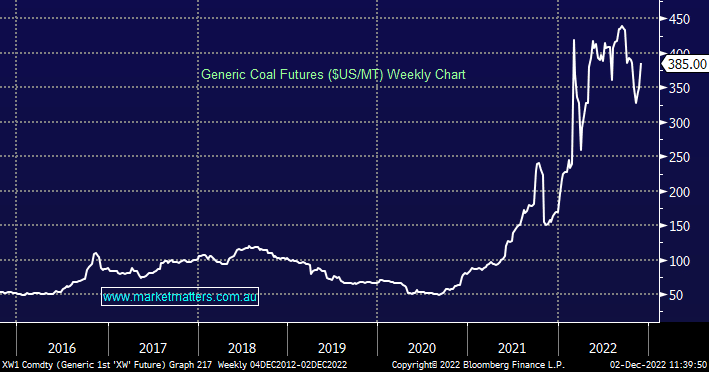

As we discussed in the recent Resources Webinar we especially like the coal space into Q1 of 2023, the Northern winter.