Hi Graeme,

The two BetaShares ETF’s you mentioned have one main point of difference which is around their respective currency risk. As you point out these are ASX listed ETF’s yet they are holding US assets such as Microsoft (MSFT US), Apple Inc (AAPL US) and Amazon.com (AMZN US).

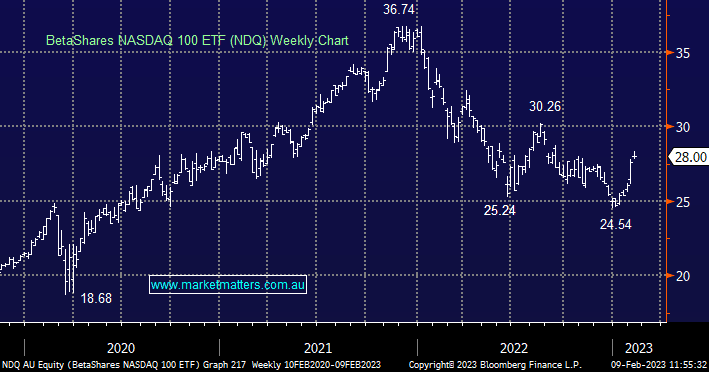

- The BetaShares NDQ ETF (NDQ) is not hedged whereas the HNDQ ETF (HNDQ) ETF is currency hedged.

In simple terms this means the hedging will ensure if the NASDAQ 100 Index rises by say 10% the HNDQ will rise by a similar amount, while the NDQ is also exposed to the vagaries of the $A i.e. if the Aussie falls by 10% your gains on the underlying stock could be wiped away and of course vice versa. Unhedged exposures generally have a smoothing effect on returns for Australian investors given the AUD is a ‘risk’ currency. When markets fall, the AUD generally falls as well, cushioning the decline.