Franking Credits & ETFs

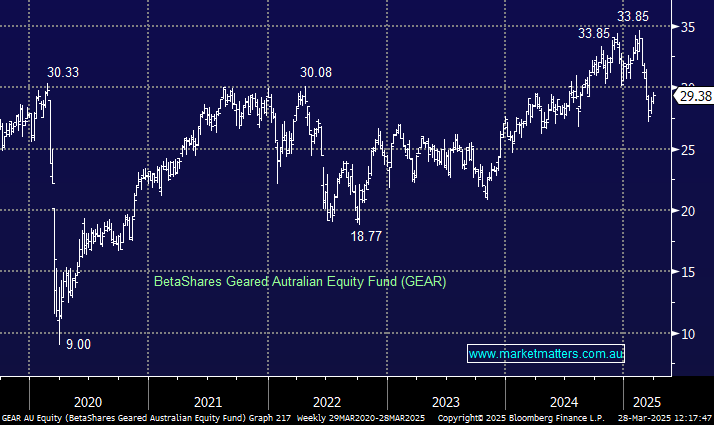

Hi MM Team, Looking forward to watching your webinar on Income but in the meantime while thinking of buying some GEAR, no not thank kind of gear, the leveraged ASX 200 ETF. Looking at their dividend yields I've seen that they are accompanied by varying franking rates that are generally well above 100%. For example last year's July dividend was, according to the Commsec website, accompanied by 789% franking. Clearly this is something to do with the gearing but I wonder how in principle this can work? Does this mean it comes with a hugely enhanced franking credit rebate? Would appreciate your expert opinion on this. Also while I've got your ear thought I might mention that it's always a bit of a process for me logging in to your website. It won't let me log in from where it says log in and I have to take a circuitous route to get to the point where I can bring up a window that allows me to do so. Is this some problem peculiar to just me and my computer? It's a great aspect of your service being able to ask questions and read your responses to the questions asked by others. Many thanks Pietro