Fixed Interest Bonds vs Hybrids

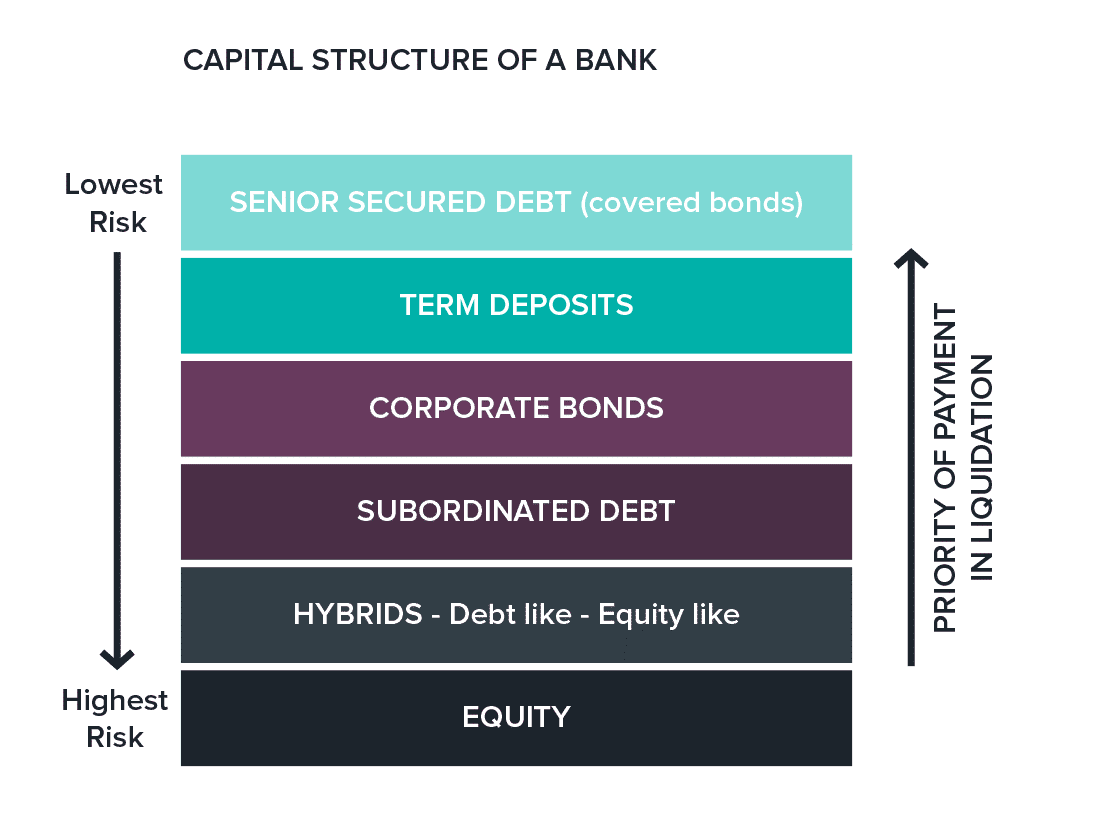

Hi James , I find your research and views of comfort in making my investment decisions. Often you highlight aspects of a stock I was unaware of. At this stage in the cycle, many retirees like myself are reduciing their Risk exposure to equities and taking positions in Bonds or Hybrids. I would be interested to hear your views on a comparison of Bonds vs Bank Hybrids. Specifically, why bother with Bonds Govt. or Commercial from FIIG, when we have the Four Pillars Bank Hybrids with an attractive margin over the BBSW rate? Particularly if one buys the IPO.