Fixed Income Products

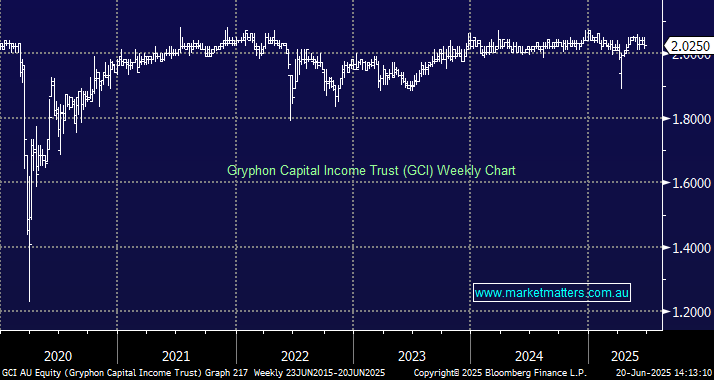

Hello James and Team, I was interested to see that you are buying DN1 for the MM income portfolio. I see that it is "powered by Realm". Your comments on REALM as an asset manager would be appreciated. Also could you comment on Gryphon Capital and Real Asset Management (RAM) who offer similar products. I recall that in a Webinar a couple of months ago James spoke favourably about Gryphon. Finally, I see that LaTrobe are releasing a product shortly (LF1). Your comments on LaTrobe would also be appreciated. I understand that your commentary is not financial advice. Kind regards, Lee