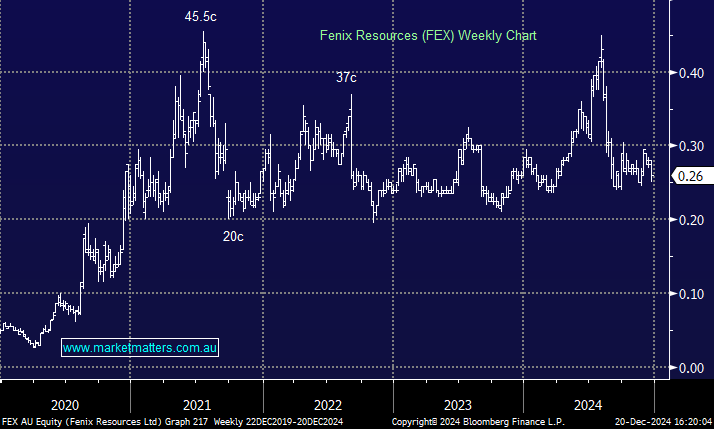

Fenix Resources (FEX)

Greetings MM Team, I am a long time shareholder of Fenix Resources and I would appreciate your opinion. What I do like about this mining company is: 1.) it is fully integrated, from shovel to onboard ships, 2.) carries relatively little debt. What I dislike is: 1.) it has stopped paying dividends, presumably to accumulate funds, for the purpose of acquiring other miners (acquisitions are always risky), 2.) the share price going nowhere, but sideways. With the lack of dividends and the price going nowhere, is there any point, to hold this stock? If you held it, would you sell it or would you continue to hold it? Best regards, John