Hi Jack,

A good question. While three instances are not a sample size from which to glean too much meaningful information, we think the reactions tell the following story:

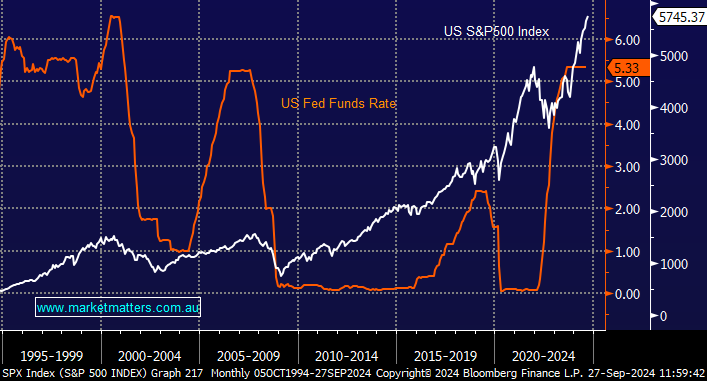

Aggressive rate cuts are generally used when the economy is sharply deteriorating, and a rapidly deteriorating economy is not good for stocks, which is the 01 & 07 experience. However, if there is not a sharp economic contraction following the cut, then lower rates in an environment where the economy holds up, is very bullish for stocks.

Our stance is best summed by the following three points:

- We will continue to give stocks the benefit of the doubt as they post record highs, remember US stocks usually follow through in the direction of the first months move after a major Fed pivot, which so far is up.

- We are far more focused on stocks/sectors to add value to portfolios as opposed the major indices.

- We will remain vigilant to any worrying signs that the US/local economies may slip into a recession which is likely to spark selling across stocks, but we’re just not seeing the evidence yet. We are seeing a gradual slowdown, easing inflation, mildly softer labour markets and the like, but nothing that worries us for now. This ‘soft landing’ if it continues along with lower rates, is a very bullish scenario for stocks.