Hi Chris,

Primarily, we try to identify a catalyst. This could be an inflexion point in earnings, when a company moves from losing money to being cash flow positive, it might be a contract win that gives them scale, or it might be an accretive acquisition – catalysts can come in many forms.

In terms of timing the buy, we usually like to see the stock starting to get some love first rather than trying to pick the low, although in the case of DroneShield (DRO) we underestimated how quickly it would move, bringing us to quote one of Shawn’s favourite sayings when it comes to being pedantic when buying a stock:

- You will always get set when you’re wrong, but not when your right! Missing out on stocks that rip higher, will often happen – that’s just the nature of the game.

Liquidity is also a critical factor; as money managers at MM (not theoretical pen jockeys), if we can’t buy or sell a stock without meaningfully impacting its price, we simply move on.

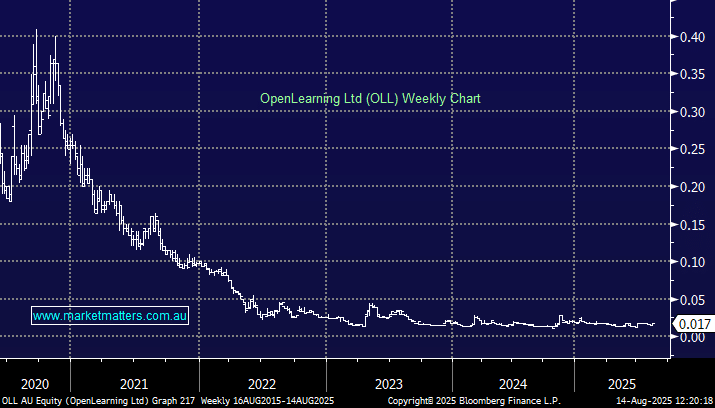

- OpenLearning (OLL) – A ~$8m Australian ed-tech company offering an AI-powered, cloud-based learning platform for educators and institutions. While the concept is appealing, the stock has fallen over 90% in recent years, and liquidity is a major issue.

- De.Mem Ltd (DEM) – A ~$30m Singaporean–Australian water technology company specialising in decentralised water and wastewater treatment systems. It’s down ~70% over the past few years and suffers from similarly poor liquidity.

These two are not really in our wheelhouse.