Hi Scott,

Two big healthcare hitters here:

- LLY is a $US725bn behemoth one of the largest drugmakers in the world who for 2025, projects revenue of around $US60 billion, driven by continued growth in its diabetes, obesity, oncology, and neuroscience portfolios.

- NVO is a $US340bn Danish multinational pharmaceutical company best know for its weight loss drug Ozempic. They recently downgraded full-year revenue guidance for 2025 by ~11% to $45.0 billion to $47.5 billion.

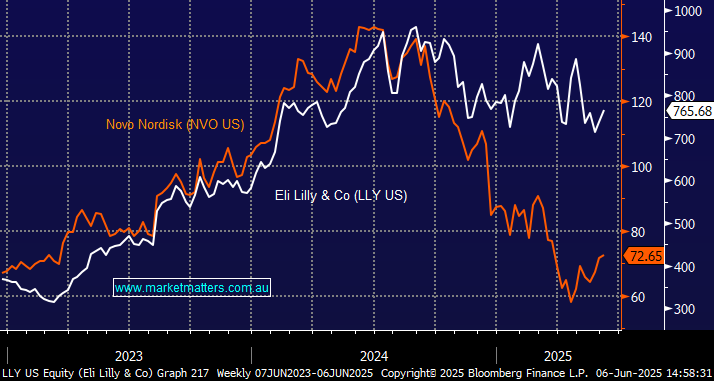

From it relative performance perspective NOVO has struggled over the last 12-months, falling by ~50%, on increased competition from LLY , disappointing clinical trial results and the emergence of Compounded GLP-1 Alternatives. Conversely LLY has fared relatively well over the same time:

- Eli Lilly’s triple-hormone agonist demonstrated up to 24% weight loss in trials, outperforming Novo Nordisk’s CagriSema, which achieved 22.7% weight loss.

- Lilly’s oral GLP-1 drug showed significant weight loss and blood sugar reduction in Phase 3 trials, leading to a 14% surge in Lilly’s stock—the largest one-day gain in 25 years.

- Lilly’s obesity and diabetes division is projected to grow by 41% this year, compared to NVO’s 25%.

Although plenty of the above is built into the recent share price move we prefer LLY over NVO and it could well find itself in our International Equities Portfolio after the recent share price consolidation.