Hi Anthony,

A great question we will cover in a podcast & / or webinar when we commence our education offering in the coming months – I have someone lined up to do this who is a more technically orientated investor than I!

There are many number of ways to place stops, below obvious pivot lows, a multiple of the average true range, a percentage basis, the key if you use them is to be consistent. Ultimately, a stop should be placed when the reason for the position is gone, I don’t believe they should be placed at say a 10% drawdown which might carry zero relevance to the position in the first place. When trading index futures and currencies etc its easier than stocks because the markets don’t close for news, except over the weekend, hence quantifying the risk is easier and “stops” are triggered as a market trades through the “get me out level”.

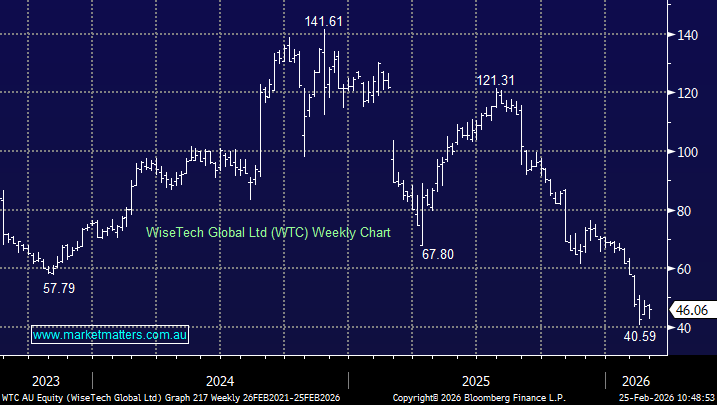

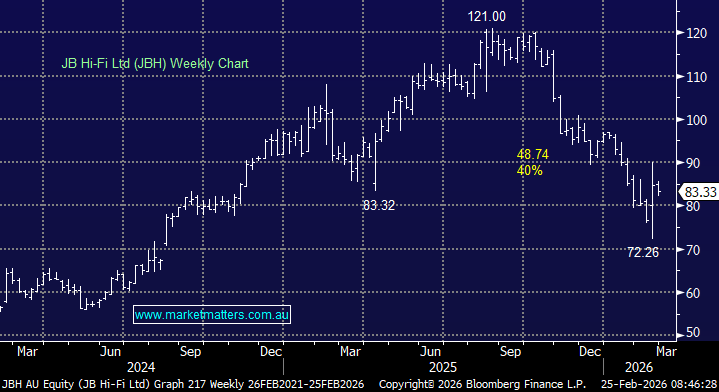

However with stocks it can be trickier as earnings reports, downgrades, takeovers are generally delivered when a market is closed hence a stop at level A might be triggered 20% lower following the news hence at times we have adopted a “watch and wait” approach after poor news which in hindsight has delivered mixed results i.e. the stock has kept falling or the dip has indeed provided a great buying opportunity.

I tend to think that using stops should be part of a completely technical trading system, i.e. it’s hard to use them when any emphasis is put on fundamental factors, but if they are used , they should be used 100% of the time and vice versa. We do not use them in our portfolio although at times we mention obvious stop levels if we can identify them in stocks we are not likely to add to the portfolio’s. In terms of examples used, it is easy to find examples where stops would have been wise and I completely get it, however we would have also been stopped out prematurely of some of our top performing positions that rallied after spiking lower. Hope that helps!