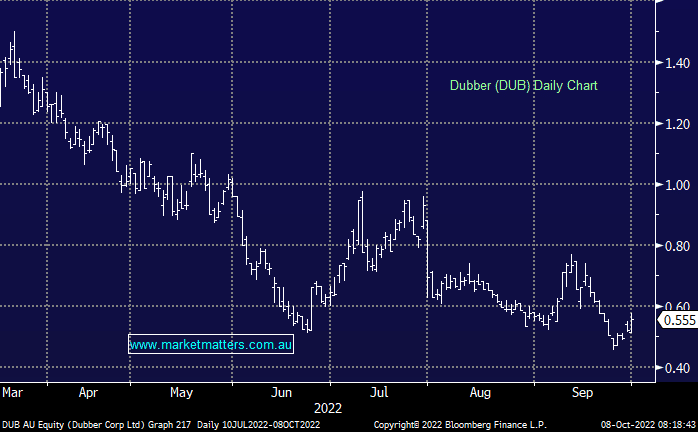

Dubber Suspended!

Hi James, Dubber Share Price has collapsed and will likely fall further. I hold Dubber bought at $1.68 so am looking at a big loss. I would be grateful if you could provide answers to the following : Why is the company taking longer than it should to get audited accounts again? Will this cause the Share Price to further collapse and effect any Capital Raising!! Excluding acquisitions, what is the company’s organic growth rate over the past 3 years? What is the company’s average revenue per user? Why does the company offer zero-exercise price options (ZEPOs) instead of asking employees to pay for their options? What is there to stop a suspension from happening again? Is Dubber Bankrupt?? Dubber was promoted by many earlier this year including MM. Now it smells like there are serious problems with management! The bottom line ---is it a Hold or Sell?? when -if it is released from suspension. As always I appreciate your insight. Richard Orr