Hi Carl,

That would have been our view as well, however, we suspect they engaged with large holders of the stock, those with blocking stakes, and that’s the price to get it done. The main holder is Rapael Geminder of Kin Group who holds nearly 21% of the stock, and previously launched a hostile takeover back in 2019, so was likely to be sticky. Post the offer, Kin group have come out publicly supporting the deal, with the price getting them over the line… hard to resist!

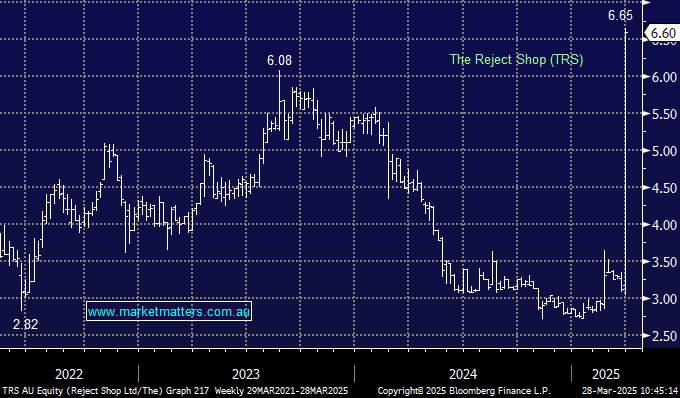

A few things to consider from Dollarama’s side – they are a $A45.6bn company who operate 1600 stores in Canada and generate sales of $C6.1bn ($A6.7bn) and net profit of $C1.1bn ($A1.2bn) with ~A$290m cash on hand at 31 January – this is not going to break the bank for them with the bid valuing TRS at ~$250m. The group says it is looking to grow The Reject Shop to about 700 stores by 2034 with current stores sitting around 390 nationally so clearly sees a major growth opportunity here locally, and will have the sufficient capital to fund expansion, something TRS didn’t have access to.

All in all, we agree that it’s a pricey bid, however, blocking stakes have that effect. You may have seen the recent bid for Domain Holdings Group (DHG) by U.S based CoStar which is 60% owned by Nine Entertainment (NEC) – the bid was $4.20, a 35% premium to last, though the shares traded all the way up to $4.76 on the day, with the market taking the view that NEC was unlikely to accept. They have subsequently increased the bid to $4.43, which is their best and final, and we’re yet to hear NEC’s view.