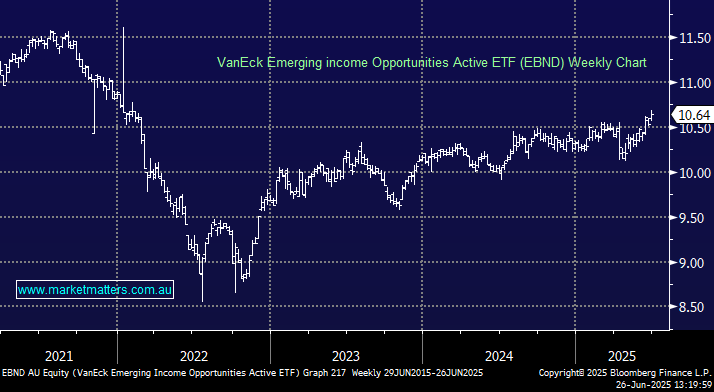

Diversification – VanEck Emerging income Opportunities Active ETF (EBND)

Hi Guys, Thanks for your continued helpful advice. I'm reading Ray Dalio's book "How Countries Go Broke". He's been talking about the rise of China, US debt etc, for several years now. Ray's macro view of investing now, a time of changing world order, is "diversify well" and stick with the countries that get fundamentals right. Fundamentals like education, a strong national income and balance sheet, greater earnings vs spending, internal order, low risk of being at war, low risk of harmful acts of nature and those that benefit most from changes in technology. Coincidentally, I recently participated in a Van Eck webinar promoting their ETF EBND. It invests in emerging market bonds and pays monthly. I was surprised to discover that that recent years have seen Emerging Markets countries appear to fit many of the financial fundamentals Ray Dalio mentioned whereas Developed Markets have generally become a riskier, less attractive alternative because of high debt. What do you think of this ETF? A good diversifier? Is it a contender for your income portfolio? Cheers, Nick