Hi Tony,

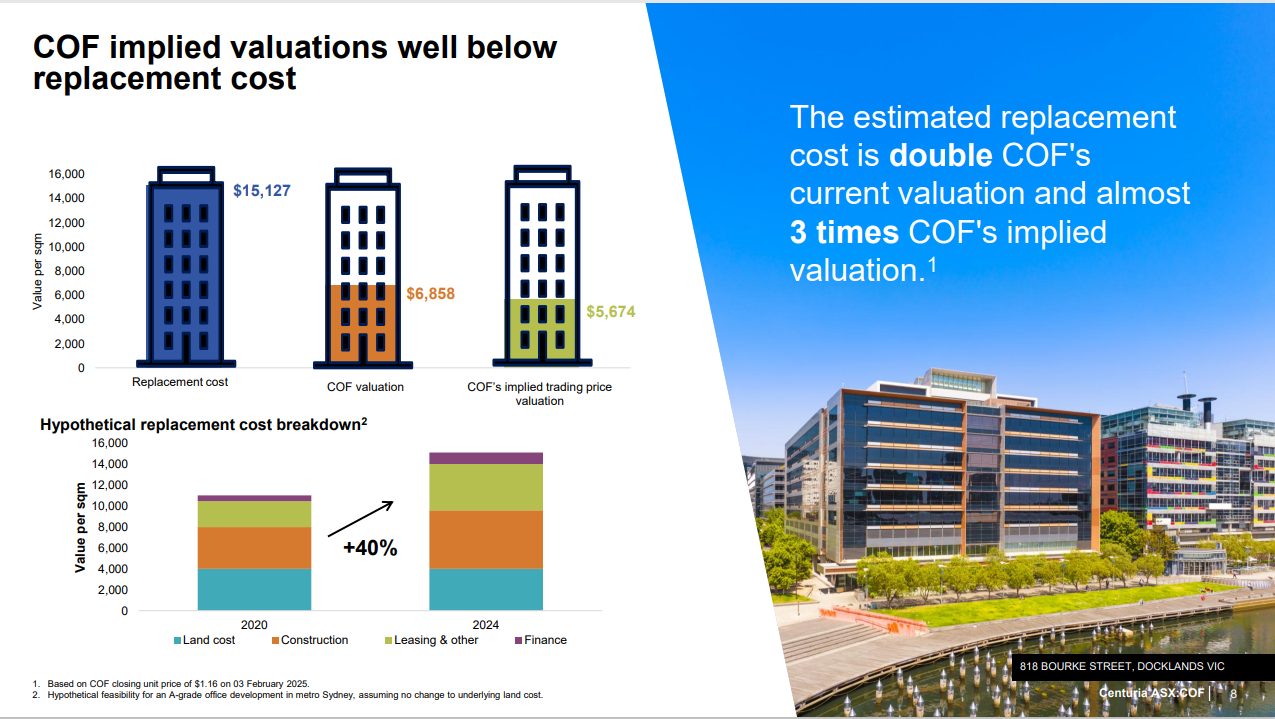

It’s a really good question and one that we discussed recently when Centuria presented to us on their office fund, Centuria Office (COF). Office REIT’s have been under a lot of pressure for all the well documented “work from home” (WFH) rhetoric, and while the jury is still out on when office will rebound, they and others are trading at very deep discounts to the value of their assets, both in terms of carrying values which feeds into their NTA, but also more acutely, relative to replacement costs. If you can buy a property at a material discount to what it would cost to build it, then that’s worth considering.

- COF is trading at a 31% discount to NTA

They do have lower occupancy than A-Grade managers like Dexus and they do have more vacancy coming, however the discount we think has captured this. The graph below we thought was a very good representation of the sorts of discounts playing out.