Hi Scott,

The US banks have looked good this week as they trade through reporting season – we hold Goldman Sachs (GS US) in our International Equities Portfolio but as you said it’s a more of pure investment bank (IB), more leveraged to M&A.

The two you mentioned both look destined for new highs into Christmas which is a solid start:

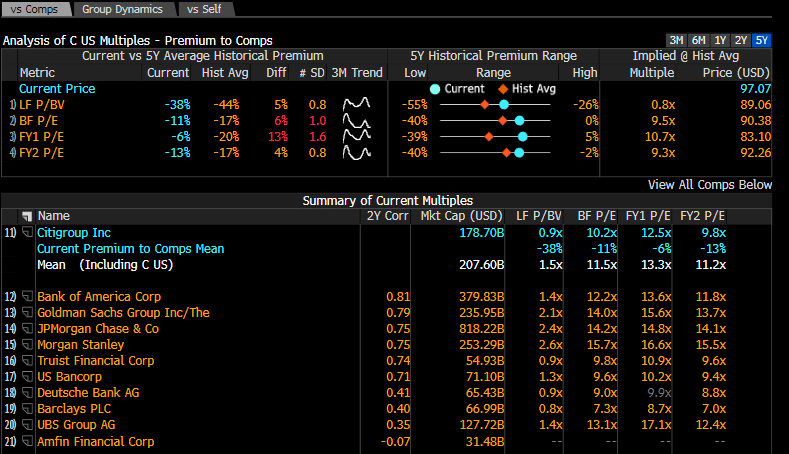

Citi has been undergoing a major turnaround under CEO Jane Fraser, pushing through a massive reorganisation of the group over the past year or so, stripping out layers of management, selling off unwanted businesses and simplifying the organisation, and we are now seeing this translate into higher returns, which should drive a continued re-rating of Citi’s multiple back towards the sector average, after a long period of underperformance.

We like their strategy, and still think Citi has more improvment to go. We actually think Citi and ANZ have similar characteristics – major underperformers for many years, now undergoing significant changes to improve returns, with competent (newish) leadership. The two we’d call ‘self help stories’ with the greatest upside from current levels.

- This weeks report from Citi was solid, with all 5 divisions now firing.

Bank of America (BAC US) – 3rd quarter earnings this week beat estimates as investment-banking activity increased amid a long-awaited comeback in M&A, though the breakdown of the revenue illustrated that BAC remains primarily a more traditional bank:

- IB revenue rose 43% to $2.05bn while net interest income climbed 9.1% to $15.2bn.

Our preference between the two is Citi (C US), believing is has more upside from a continued re-rate of it’s multiple as returns improve.