Hi Young,

China has undoubtedly weighed heavily on the ASX and specifically our Resources Sector although its not all been bad news in 2024:

- Copper: Sandfire Resources (SFR) +18.6%.

- Gold: Ramelius (RMS) +14%, Northern Star (NST) +3.5% and Evolution (EVN) +0.6%.

- Iron Ore: RIO Tinto (RIO) -12.9%, BHP Group (BHP) -17%, and Fortescue (FMG) -36%.

We’ve discussed a number of times in recent months that we are considering increasing our BHP position under $40, now less than 5% away. Hence, if we are correct the weak Chinese economy should find some support in the coming months but there’s still no reason to increase exposure.

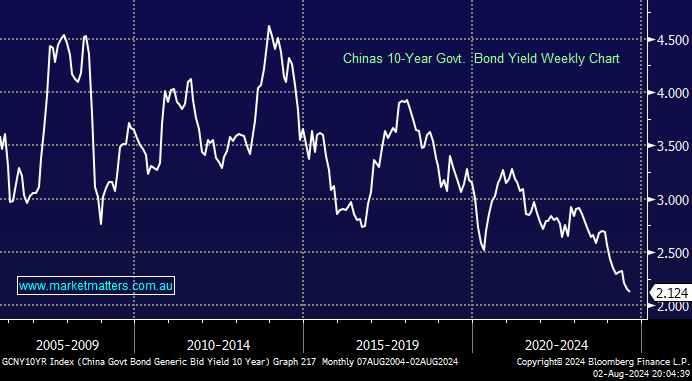

We read the same article in the AFR although we’re not convinced China’s surging bond market (prices higher & yields falling) is a huge problem just yet, how else will their property market stabilise/recover. The grind lower in bond yields shows investors are betting more rate cuts will be required to stimulate the worlds 2nd largest economy, one of the reasons that the Chinese have been a major buyer of gold in recent years.

Consumers are unsettled by the property crisis, which shows no sign of abating with house prices falling at the fastest rate in a decade last month BUT things always look their worst as they reach a nadir. China is facing 3 bubbles, at different stages in their cycle (property, plus credit and investment markets) also we have the risk of Trump winning in November, with the risks of tariffs designed to hurt China’s economy. However, Harris is becoming a more formidable opponent by the day:

- At this stage MM will go out on a limb, believing Kamala Harris will win the US election, good news for resource stocks, or at least not bad news!

Ultimately, we think China will be forced to stimulate more aggressively to arrest the pressures above, however, our view around commodities is more about imbalances between global supply and demand, underpinned by the energy transition.