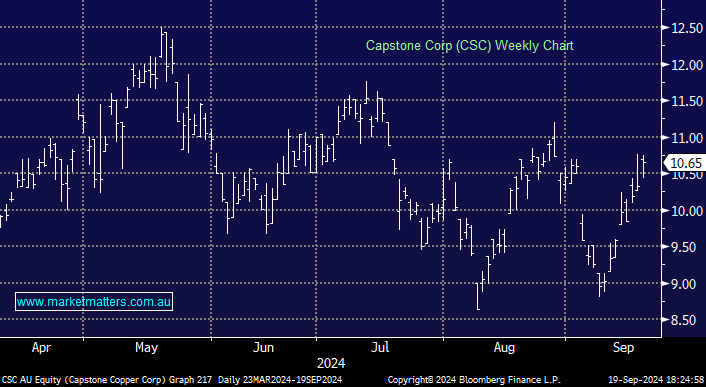

Capstone Copper (CSC) – a copper alternative ?

WIRE.AXW - the Copper Miners ETF, is often suggested as alternative copper exposure to Sandfire but WIRE's management fee is 0.65%. That is equivalent to about 25% of WIRE's dividend yield. I'd rather consider direct investment in Capstone which has five copper mines in the Americas, has a 4.36% weighting in the WIRE ETF and is listed on the ASX as a CDI with the ticker CSC. Why does Capstone get so little coverage in Australia ? Is the market cap. only $1.2B as stated by IRESS or is that the market cap of the CDIs. What are your thoughts on Capstone ?