Hi Danny,

We hold two of the large cap miners mentioned believing they offer great value as medium to long-term plays, but we are cognisant that a turnaround in the fortunes of China is required before they can really start enjoying a meaningful turnaround of fortunes – we have been overweight the miners over the last 3/6-months and it’s detracted from the performance of our Active Growth Portfolio. That said, we don’t believe now is the time to be reducing our overweight bet, and if we did not own them, we would be buying them.

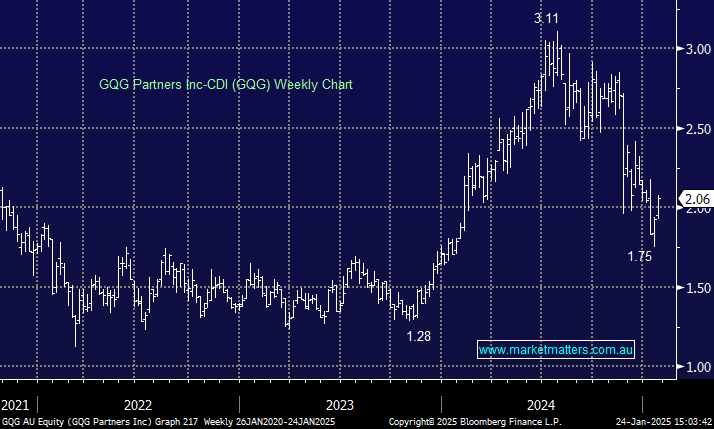

We have been watching GQG’s aggressive pullback over the last 6-months with interest, in simple terms, a fund managers share price will follow FUM flows, and FUM flows follow performance with the recent disappointing performance leading to the re-rating. Also, we saw the almost capitulation sell-off in-line with Adani’s plunge after the founder was charged by US authorities over an alleged $US265 million bribery scheme – GQG was caught with a huge almost $US10bn investment in the group, or around ~6% of total assets.

The thing with fund management businesses, is their model is great when funds are flowing in, the operational leverage is huge given a generally fixed cost base, however outflows have the same influence in reverse. Magellan (MFG) is a real-life recent example of this.

We don’t think GQG will be another MFG per se, and we do see value following the big correction in share price. We have remained patient though, as we know these things take time to work through, and outflows can persist for a long time after such a big, well publicised issue, that has a lasting impact on the perception of the manager, particularly when a long and drawn-out legal process (towards Adani) is now underway.

- We will be watching their performance through 2025 closely, and after falling over 40% from its 2024 high, GQG is very interesting to us, particularly after we took profit in Magellan late last year.