Bond movements

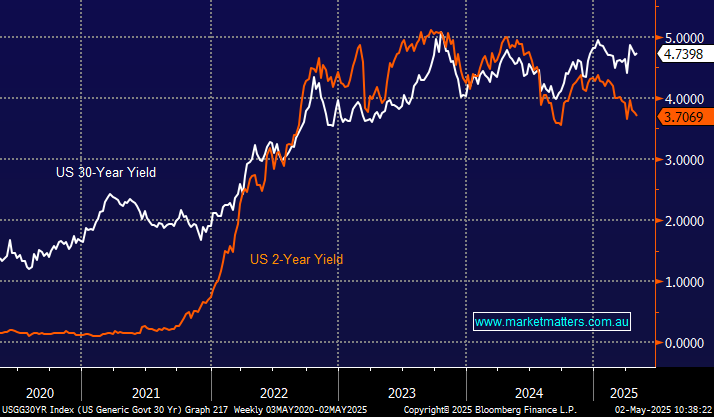

Hi guys, hope you all had a good break last week with the public holidays. Could you please explain what's been happening with U.S. bond prices lately? Do stocks prefer going off the 2's, 10's or 30's? I understand that with Trump changing his mind every thirty minutes that it upsets the balance, but one moment Stocks are following bonds, then the next it's against it. What is the current sentiment towards them. The 30's aren't far off the high yields from liberation day but not as high as the start of the year. If they were getting sold off by the likes of China and other countries, then surely the yields would be dropping and stocks would like it. If stocks were following the 2's then things would be looking good. Right now I have no idea where the smart money is going or even what is doing the leading. The elephant in the room would be a large sell to move away from USD$, which we have seen and the money going to gold; if this continues or even expands, what are the knock on effects and where do the funds go / how does the US manage such high yields? regards, Simon