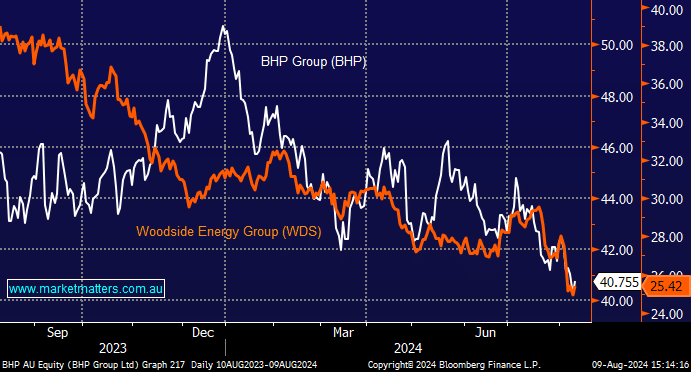

BHP/WDS dividends and growth potential.

Hi MM, Both BHP and WDS share prices have suffered lately - BHP because of declining iron ore prices and WDS through some capital intensive purchases (LNG processing and green ammonia). Both have dividends coming up - what do you expect these to be? I hold both but if I wanted to add to a position, which stock do you favour and why? Regards, Peter