Hi Glenn,

A few questions here, let’s take a look one by one:

Bowen Coal (BCBDB): This ~$37mn coking coal operator continues to drift around its all time lows, unfortunately we see no reason to consider BCBDB as either a trade or investment.

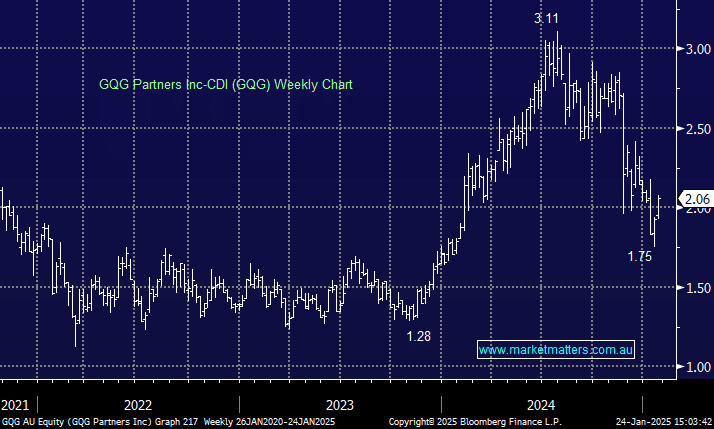

GQG Partners Inc-CDI (GQG): You have to take the good with the bad when investing in active/aggressive fund managers and GQG has struggled over the last six months, primarily due to its substantial investments in India-based Adani Group. However, it was good to see their FUM improve in March and we like GQG around $2, its cheap in relative terms and MM wouldn’t be surprised to see it test $2.50 later in the year assuming the share market holds together during Trump 2.0.

Helia (HLI): This mortgage insurance business has struggled after potentially losing their exclusive contract with CBA as the provider of choice for Lenders Mortgage Insurance (LMI). It was interesting ~$3.50 but we wouldn’t be chasing it around $4.40.

We are of the opinion that traders/aggressive investors can buy decent dips in the current market but we are more inclined to focus on the higher quality end of town which dragged the market up in 2024 before becoming crowded and overpriced, i.e. they are now interesting with many now having corrected 20-30% and even more in some cases like Pro Medicus (PME).