BCB and GQG

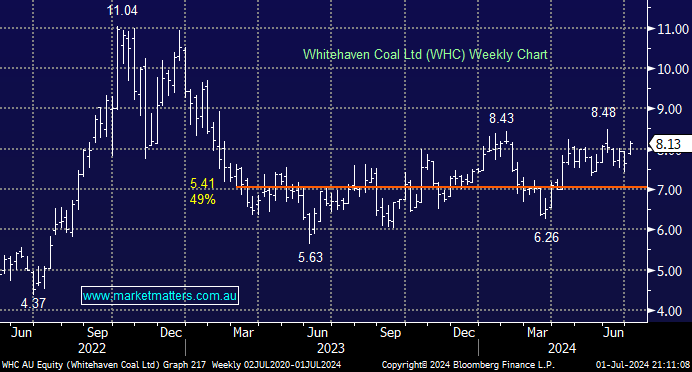

Hi , I bought into BCB when you guys did but did not get out when you did , it has continued to slide I thought it can not go lower as we all know COAL will be needed for a long time yet , The climate cult is not facing reality in my view , The other producers I own WHC , NHC have made me money so why does BCB continue to fall ?.......And I own some GQG but am under weight what is your view on this stock , buy , hold , sell ?