Hi Alex,

Selling the banks has created major underperformance across many fund managers portfolios in 2024, even a after slipping over $10 this week, as resources enjoyed a resurgence, CBA is up well over 20% year-to-date, i.e. ~3x the ASX200.

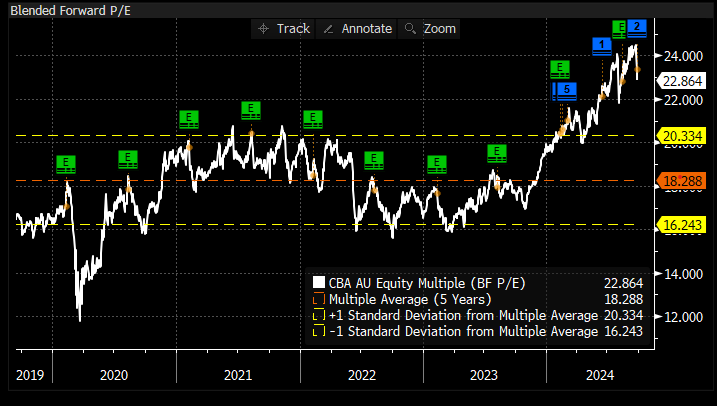

As the chart shows on Wednesday CBA was still trading ~25% above its 5-year valuation but many pockets of the market are on the expensive side. With banks, while lower rates will help loan growth, which is positive, as some of the US banks have highlighted recently, as rates come down, margins could come under pressure again.

We are now underweight the banks overall, and don’t believe their FY24 performance will be mirrored in FY25.

- We hold 6% of our Active Growth Portfolio in ANZ, its very unlikely we will migrate further away from the banks considering the “Big Four” make up ~20% of the ASX200.

- Similarly from a direct banking exposure perspective our Active Income Portfolio holds 6% in CBA hence again we aren’t likely to sell further.

CBA looks/feels rich on many metrics and its now only paying a ~3.5% fully franked yield, hence we’re not buyers at current levels but ~$125 it would start to get interesting again.