Are the Aust. Government Treasury Bond 2025 3.25% (GSBG25) illiquid?

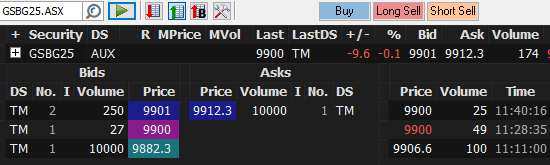

15/6/23 MM is adding the above to its Active Income Portfolio. I am not familiar with dealing with bonds so I typed the code on Commsec search and to my surprise, results shown were, currently 1 seller and 2 buyers only, and 2 trades done at 10.35am. Are there any other trading sites etc that has a higher turnover/ activities?