Hi Richard,

Money flow into/out of ETFs can certainly skew markets as they buy or sell, the basket of stocks to follow their respective models.

- The total FUM of ASX ETFs hit around $300 billion in 2025, with inflows of tens of billions per year, the retail segment is likely a significant contributor but likely less than half of total FUM, with institutional/SMSF flows remaining large – as you say money has poured into ETFs.

- However, as is usually the case where there’s winners so there are losers – though there’s been a retail trading boom during COVID‑19 and in FY25 the number of truly active traders in individual ASX shares is still smaller than in the 1980s when the chalk boards and trading floor reigned supreme – Shawns old domain!

As we often say, earnings ultimately drive share prices. ETFs, which are generally market-cap weighted, tend to support stronger, larger-cap stocks, while weaker stocks see little direct benefit. Overall, we don’t believe ETFs are creating a bubble per se although at times they may increase volatility. However, in certain areas—such as gold or some defense names recently—complacency and hot money can quickly become an accident waiting to happen. Still, those looking to “punt” on gold will usually find a way, as we saw with the cues in Martin place this month.

- ACDC – remains bullish but a 10% pullback wouldn’t surprise from here – battery tech and lithium focused.

- Gold – we are now bullish gold and its respective ETFs after the last 3-week’s sharp correction.

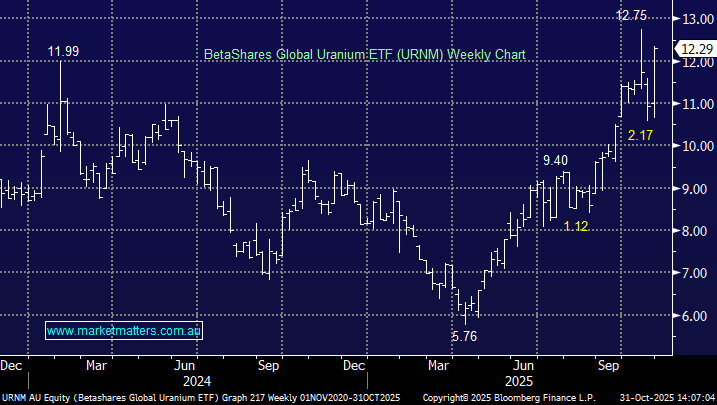

- URNM – we remain bullish on the nuclear and uranium theme into 2026.

- ATOM – we remain bullish on the nuclear and uranium theme into 2026.

- ARMR – we are neutral here and a 10% pullback wouldn’t surprise – defence focused.

- DFND – we are neutral here and a 10% pullback wouldn’t surprise – defence focused.