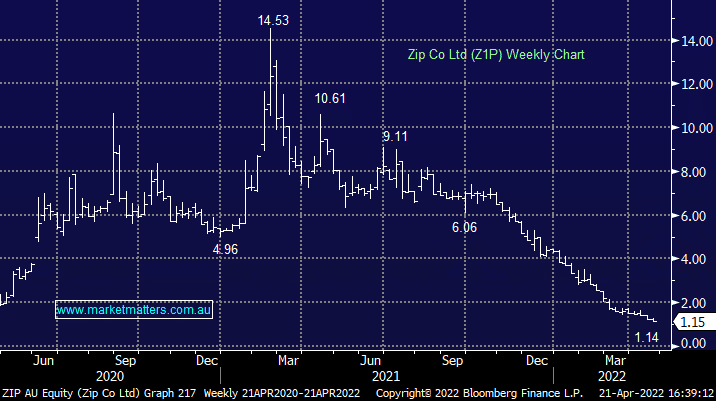

ZIP -4.56%: the BNPL company was out with their quarterly report for the 3 months to March and there was a bit to unpack – they also started trading under their new code, ZIP, previously Z1P (number 1). Shares initially traded higher but faded through the afternoon to close lower. Transaction volumes grew 26% year on year to $2.1b while revenue grew 38% to $159m as the business saw transaction margins pick up. Credit losses remain an issue, tracking in line with the 2.6% seen in the first half, one of the key reasons the business has been under pressure. It’s hard to see a runway to profit if you’re giving back what you earn (and then some) on each transaction. They’re working on their costs with $30m to come out in FY23 while the changes they’ve made to their risk settings is likely to start coming through in lower credit losses late in the financial year, but more so in FY23. The Sezzle (SZL) acquisition remains on track and the business is now targeting breakeven in FY24. Overall an average update, but no worse than the half-year.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

MM holds a small position in ZIP in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Zip Co Ltd (ZIP)

Can the US carry ZIP until Australia play catch-up

buying stocks in emerging portfolio

Zip

Thoughts on ZIP Co & AIC Mines please

Thoughts on Life360 (360) and ZIP Co Ltd (ZIP) please

ZIP

ZIP

Comments on ZIP Co. (Z1P) please

ZIP – Will ZIP die or thrive?

Is the BNPL Space still too expensive?

What’s MM’s thoughts on stop losses?

Emerging Companies TYR and ZIP a hold or sell?

How should we play Zip from here?

Is Zip (Z1P) wrong?

Is it time to take tweak some positions?

Is Jono Higgins still bullish Z1P?

5-6 questions rolled into one

What stocks would we top up here?

MM thoughts on Zip (Z1P) going into crypto?

What does the APT deal mean for Zip Co valuation?

BNPL Podcast

What does the word active mean in portfolios?

Zip and the Westpac overhang

MM thoughts on Zip

Clarifying our position on Z1P

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.