The maker of high-end coolers (and soon-to-be Skillets!) reported Q2 sales and profits that were nicely ahead of expectations overnight, while they also increased annual guidance, a beat and bump pushing the stock up 16.5%. Our thesis on YETI is about quality, innovation and brand, and the overnight results were great, particularly given it’s been a challenging period for management as they grappled with higher costs. How a business performs in the tougher times is really important, and YETI has delivered.

- Sales $463.5 million, +15% y/y, estimate $452.4 million / 2.4% beat

- Adjusted EPS 70c vs. 57c y/y, estimate 64c / 8.5% beat

The bulk of YETI’s business is in the US. However, they’ve started to expand internationally, particularly in Europe & Australia, i.e. they sponsor the Nth QLD Cowboys in the NRL, and the overnight result showed a 3rd consecutive quarter of over 30% growth in their international business. They increased their full-year guidance and now see sales up 8-10% (from 7-9%) and underlying EPS of $2.61-$2.65, up from $2.49-$2.62 (mkt was at $2.59). However, they did comment on strong exit momentum from the period, so this guidance could prove conservative.

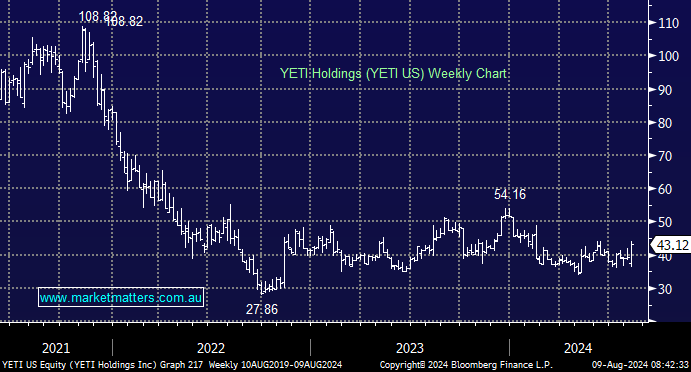

- YETI US currently trades at 15.5x, nearly its cheapest multiple since listing (the average multiple is 22.8x). It is growing earnings at ~15%, has a phenomenal brand and great management, and is trading at the right price—we would be buying if we did not already own.