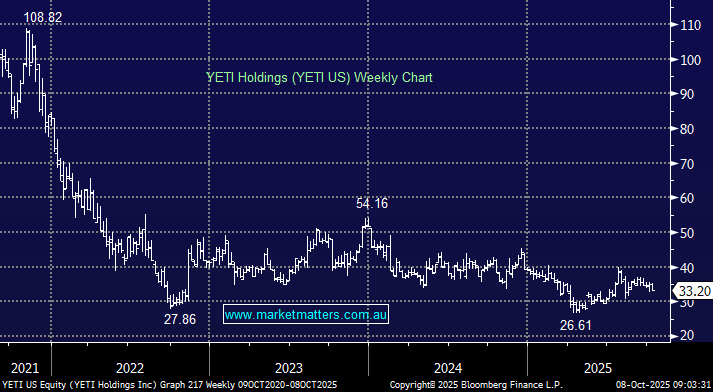

The high-end cooler, drinkware and accessories company has been a stock we’ve liked for a while now, having bought in early 2023. To date, it’s been underwhelming and we’re sitting on an open loss of 14%. Today, we’ll outline why we think patience is still the best approach with this holding, even though it’s failed to live up to expectations.

The operating environment has been tough. Tariffs have forced YETI to diversify where it sources products and this had led supply disruptions, added costs and margin pressure at a time when retail sentiment has been very cautious. This led to lower visibility on earnings and generally a more uncertain operating environment in the short term. It’s understandable why investors have been sitting on their hands, and YETI has not enjoyed the strength of the broader market.

Because of the cost and supply chain drag, YETI reduced its earlier sales and operating margin guidance:

- New sales growth guidance trimmed to 1–4% (from prior 5–7%)

- Operating income as a share of sales guided to ~12% (vs earlier ~16.9%)

YETI is now targeting a shift such that ~80% of U.S. drinkware production will be outside China this year, accelerating from prior targets, moving to a more diverse manufacturing presence in Mexico and Southeast Asia (Thailand, Vietnam, Malaysia, Philippines, Taiwan, etc.).

Despite these near-term headwinds, YETI remains one of the strongest lifestyle brands in the US consumer discretionary space and management continues to broaden the product mix beyond coolers and drinkware into bags, outdoor gear, and travel categories, with new launches slated for FY25–26, which should help reaccelerate both top-line growth and brand engagement.

Jefferies recently hosted a fireside chat with YETI management and came away “encouraged” about an FY26 acceleration, supported by a healthy pipeline of new product launches and operating leverage. Jefferies flagged web traffic growth in August remained strong following July’s inflection, suggesting that Q3 performance could surprise to the upside. They are buy-rated with a $53 price target, saying they would “remain aggressive buyers of shares at current levels.”

- This aligns with our own thinking — that YETI is nearing the end of a consolidation phase, with earnings leverage and new category growth starting to emerge.