The beverage-cooler maker’s Q4 results overnight were broadly in line to slightly ahead of expectations, and while guidance was solid, they still see some ongoing challenges in the market.

- 4Q sales of $US546.5 million, up +5.1% yoy, about 1% below consensus of $US552 million

- Adjusted earnings per share (EPS) of $1.00 vs. 90c yoy vs estimate of 93c, a 7.5% beat, driven by better cost control and a lower tax rate i.e. not better growth.

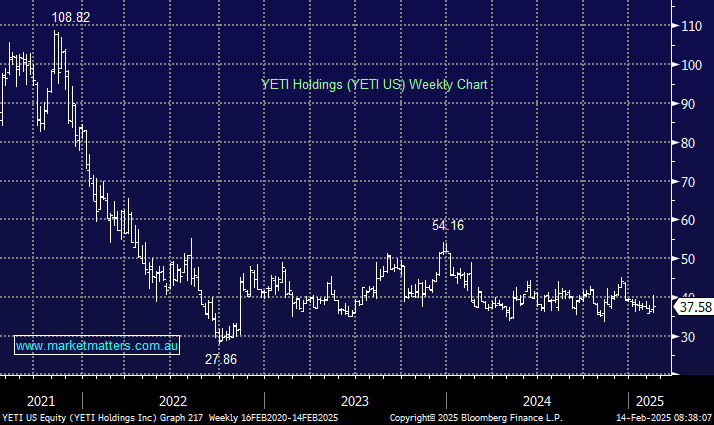

The stock opened up ~5% before tapering off throughout the session as they highlighted that some of the conditions that had a negative impact on the 4Q outcome were still prevalent. Their FY25 guidance for sales growth of 5-7% and earnings per share (EPS) of $US2.90-2.95 was in line with street expectations.

- YETI is trading at a depressed PE of ~13x and should grow earnings by 5-10% if it meets guidance. We remain positive on YETI and hold it in the International Equities Portfolio.