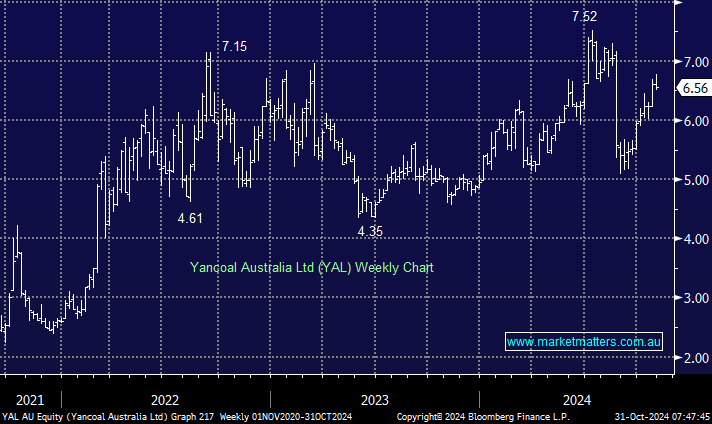

Yancoal (YAL) is a proxy for a Chinese-listed coal company that will/has conducted business on its terms; hence, it is not for us, i.e. the directors recently overrode the company’s constitution, which states at least 50% of net profit must be returned to shareholders. They kept the cash on hand for future acquisition (s) with Anglo American’s QLD coal mines as one of their targets.

- Further corporate action looks likely in the coal sector, as bigger businesses look to reduce costs and improve efficiency through scale.

- YAL has plenty of cash to increase its suite of assets, but how this impacts dividends will only be known over time; importantly many shareholders are only in YAL for the dividend.