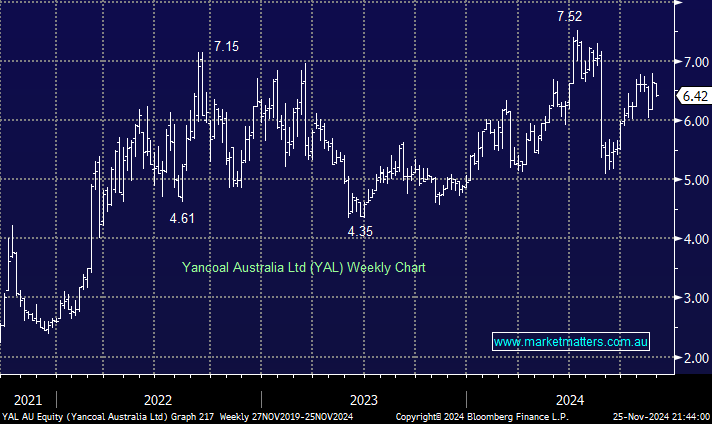

YAL has moved from a strong dividend payer to a coal miner on the acquisition trail. After suspending its dividend, YAL now has over $1.5bn on its balance sheet to fuel expansion by acquisition. The company remains a proxy for a Chinese-listed coal company, which will/has conducted business on its terms; hence, MM has no interest.

- We are not fans of a business whose board can dramatically change the goalposts for investors by overriding the company’s constitution.