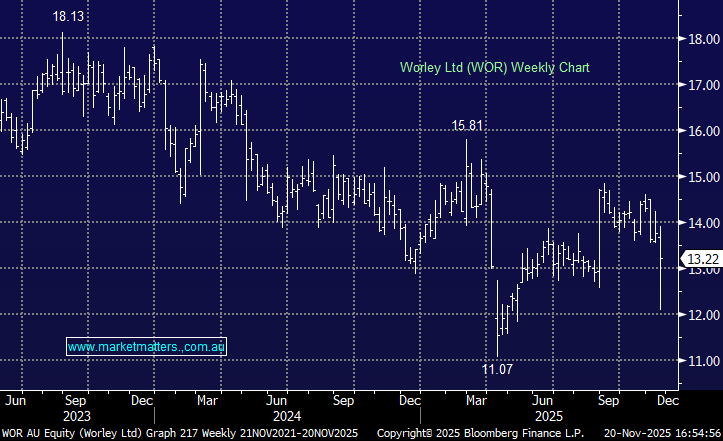

WOR –3.15% was down over 11% early before recovering on CEO comments at the AGM today. While they reconfirmed FY26 guidance, with moderate growth expectations retained, there were a few things that had the market of edge early.

- They said conditions remain subdued in pockets, but backlog growth provides confidence

- Earnings will be heavily second-half weighted, more so than usual

- Repositioning talent and capability into higher-demand areas

- One off cost’s incurred as a result.

Underlying EBITA margin (ex-procurement) expected to stay within the 9.0%–9.5% range, seeing customer demand is strongest in LNG, critical minerals, low-carbon fuels and power generation.

While there are a few moving parts here, they were confident on second half earnings visibility, though it does not appear to MM that things are really firing.