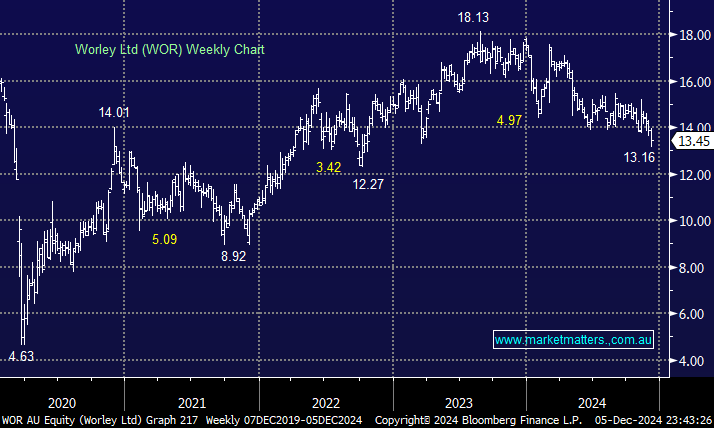

In April, Worley’s largest shareholder, Dubai-based infrastructure group Sidara (née Dar Group), locked in $14.35 a share for its sale of a 19% stake, a 12% discount to its last trade at the time. The sell-down showed Sidara had abandoned hopes of acquiring Worley or striking a broader strategic relationship with it seven years after starting to build a stake. In this case, two tailwinds were removed for WOR:

- The prospects of a blatant takeover/bid for WOR were removed.

- A significant number of buyers/supporters of WOR had their appetite satisfied.

The stocks subsequently underperformed in 2024, trading lower in a rising market. Operationally, there have been no negative surprises from WOR, although companies are being cautious in their path towards net zero. This has softened relative to FY24, which has impacted WOR’s pipeline of work and speaks to the path towards net zero taking longer than many expect, especially since Trump’s victory. However, the destination is still not being questioned.

- We like WOR as a business but clearly, the big block sapped buying support in the broader market. We are re-evaluating the direction of the stock through early 2025– MM holds WOR in its Active Growth Portfolio.