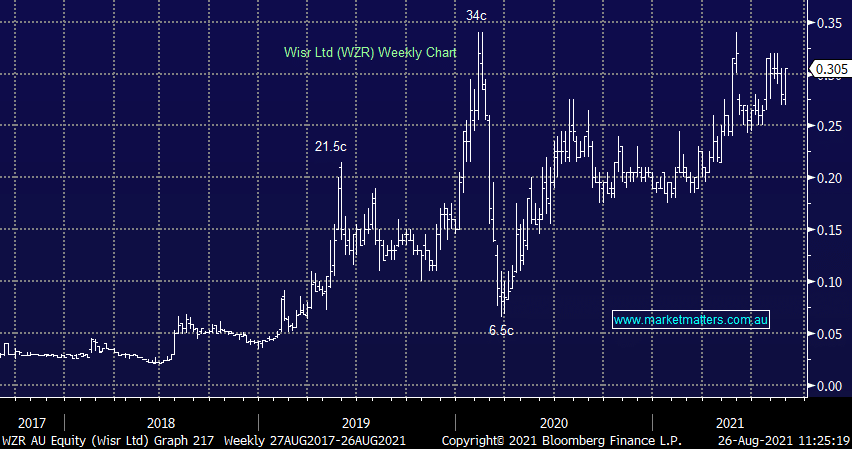

FY21 Result: While the result was largely pre-released todays update did re-affirm the strong position the personal lender is in. Revenue jumped 280% to $27m while EBITDA losses tightened to less than $10m, both slightly ahead of expectations in FY21. Loan growth and lower funding costs are key to the story, and both are performing well. Wisr managed to grow total loan originations 149% in the year while bad debts tracked only marginally higher to 0.92%, speaking to the exceptional credit quality of the book. Funding capacity continues to improve with Wisr managing their first asset-back security (ABS) sale in the period which cut funding costs in half. Overall a positive update with WZR trading up over 6% at the time of writing.

scroll

Question asked

Question asked

Question asked

Question asked

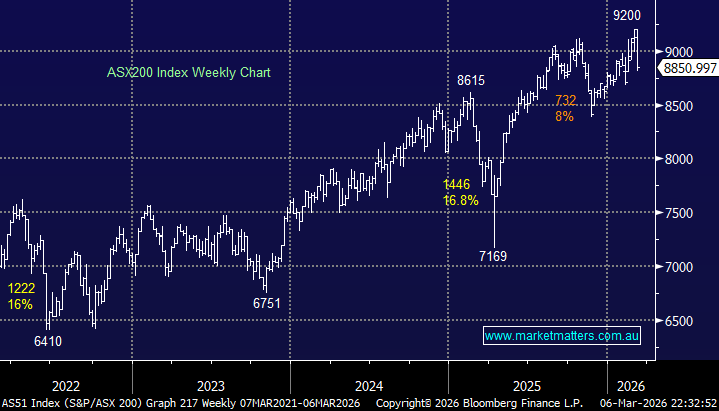

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

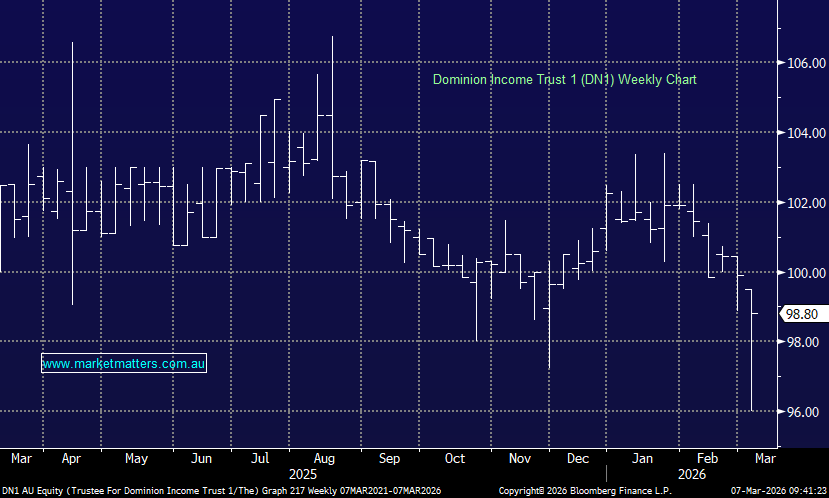

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM remains positive WZR

Add To Hit List

Related Q&A

WZR

Switching from Wisr to Liberty?

What’s up with Wisr (WZR)?

Australian Strategic Materials & Wisr- MM’s take

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.