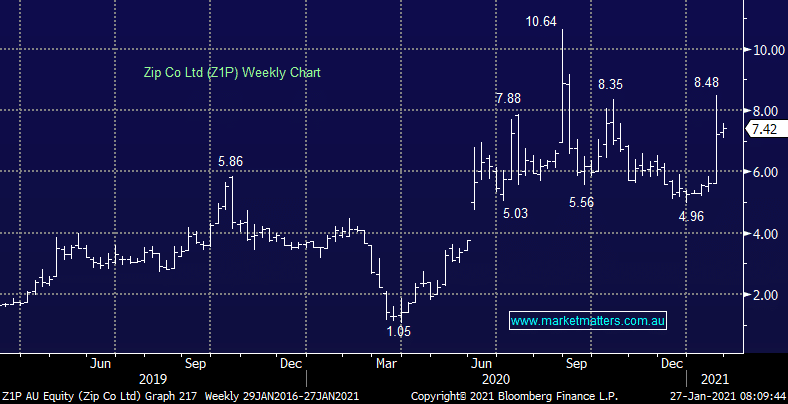

The “Buy now pay later (BNPL)” space has been a major interest for many subscribers which is understandable considering the sectors major volatility, at this point in time we continue to back our holding in Z1P believing some value catch up is likely over the weeks / months ahead, the maths is simple:

1 – Afterpay Ltd (APT) has a market cap of $41bn compared to Z1P’s at $4bn i.e. 10x larger.

2 – Afterpay (APT) only transacts 2.5x more than Z1P.

The bulls on APT / bears on Z1P will sight the first mover advantage, the concept in technology that ‘winner takes all’. That’s a concept that we’ve written about before and believe in, however there is a caveat to it around the size of the addressable market. The BNPL opportunity is huge in the US and other countries around the globe. Australia is a tiny market where BNPL has high penetration – in other words, it works here and there are signs that it is working globally. Large companies like Tencent (700 HK) are investing in it and if other larger markets experience anywhere near the take-up that’s been achieved in Australia, then it bodes well for more than just the dominate player in the space.