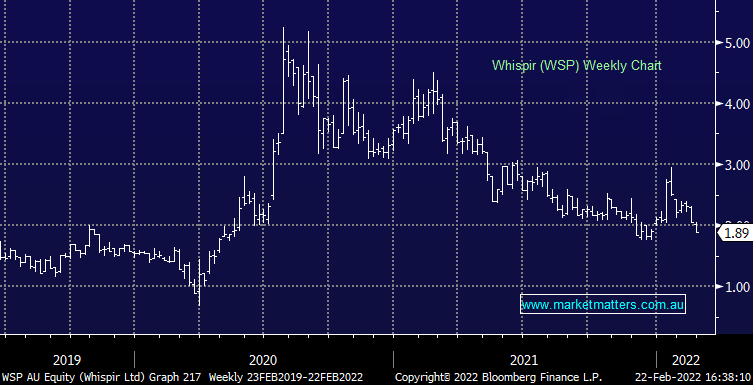

WSP -5.5%: the cloud communications business posted a strong 1H22 result this morning however the stock was weighed on by weakness across the small ords. Revenue jumped 70%, helped by a strong transactional performance. This did weigh on margins though, but EBITDA was still ahead of expectations at a loss of $3.7m. They noted a ramp up in average reoccurring revenue (ARR) in North America while churn rates remain low (-1.8%). Guidance was maintained however it is looking extremely conservative and implies very little transactional revenue and ARR growth in the second half. They also expect margins to return towards 60% with a greater portion of sales coming from platform while the recent Singtel partnership should continue to boost performance.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM continues to hold WSP in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Does MM still like Whispir (WSP)?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.