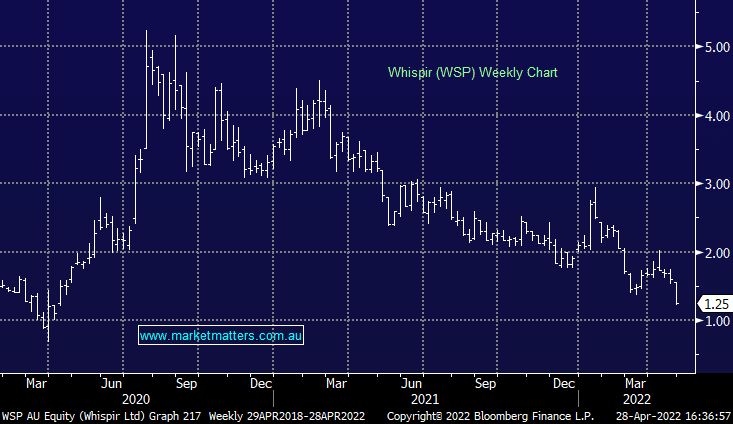

WSP -14.97%: cloud communications business Whispir was out with their 3rd quarter update yesterday with numbers largely in line with expectations. Revenue targets were pushed to the top end of guidance near $68m with Annualized Recurring Revenue (ARR) up 245% YoY to $62.4m. Costs were down as well with the headcount reduced slightly, though total cash burn was marginally higher. Numbers are trending well into their seasonally strongest final quarter so it came as a surprise to see the selling pressure on the stock today. While the performance was solid in our view, the market was aggressive on the sell-side today.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is reviewing WSP ~$1.25

Add To Hit List

Related Q&A

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Does MM still like Whispir (WSP)?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.