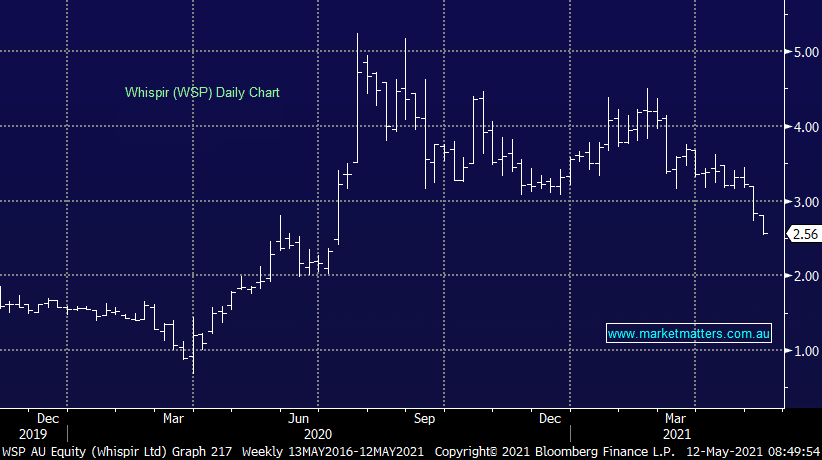

The cloud communications software business has been on the nose since raising money in March, now trading at a ~30% discount to the price set in the institutional placement. Like a lot of the tech space, Whispir has been caught up in the growth sell off which is starting to throw up some long term growth opportunities at reasonable prices.

The company touted 25-30% annual recurring revenue (ARR) growth in its North American business in FY23. Their forecasts also include conservative APC growth of ~20% vs the 30+% we have seen over the last 2 years. The numbers could be impressive, however there is clearly risks around execution and the share price is unlikely to find support without some positive deal flow news which has been lacking of late. However with shares now around 50% below last year’s high, WSP now trades on just ~4.6x forecast FY22 sales which appears exceptionally cheap if the company can hit targets.