A softer session today, giving back a portion of yesterday’s solid move, though trading was quiet; volumes anemic and most focus is now on the Christmas break, with a 2.10pm close this afternoon.

The Market Matters office will be closed from this afternoon, re-opening on Monday 19th January. During this period, if anything significant happens in the market that warrants a change to portfolio positioning, we will send this via our normal alerts. For any other urgent matters, you can contact us by sending a message via the website here

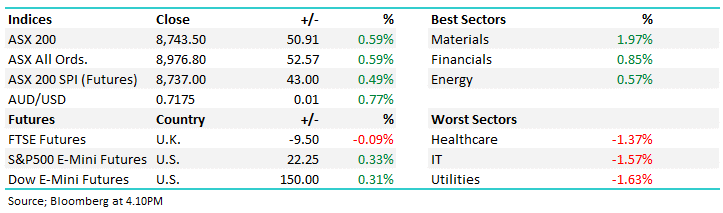

- The ASX200 fell-33pts/-0.38% to close at 8762.

- Materials (+0.29%) the only sector to make gains.

- Healthcare (-1.60%), Consumer Discretionary (-0.66%) and IT (-0.88%) the weakest links.

- Materials benefitted from copper strength with prices now above US$12,000/t for the first time on supply concerns, while gold pushed to fresh all-time highs.

- Lithium stocks also rebounded as prices hit their highest level since November 2023; Pilbara Minerals (PLS) +6.3% and Liontown Resources (LTR) +4.7%

- Treasury Wine Estates (TWE) +7.6% rallied after a Luxembourg-based investment vehicle backed by former consumer goods executive Olivier Goudet lifted its stake to 5.05%, adding fuel to speculation around strategic change at the Penfolds owner.

- Lendlease (LLC) +4.6% climbed 4.7% after winning the Sydney Metro Hunter Street West over-station development, strengthening its CBD development pipeline.

- Monash IVF Group (MVF) -10.4% was hit after a takeover bid led by Genesis Capital and Washington H. Soul Pattinson (SOL) was withdrawn.

- DroneShield (DRO) +0.6% after securing a $6.2m standalone contract linked to an Asia-Pacific military customer.

- EVT Limited (EVT) -1.1% fell after agreeing to acquire the QT Auckland hotel for NZ$87.5m, expanding its hotel footprint.

- Seven West Media (SWM) +4.2% in its final ASX session following the completion of its acquisition by Southern Cross Media (SXL).

- Gold was flat at US$4483/oz.

- Iron ore was lower trading $US103.65/mt

- Asian markets were higher, with China up +0.1%, Hong Kong +0.40% and Japan up +0.1%

- US futures are mildly lower