- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

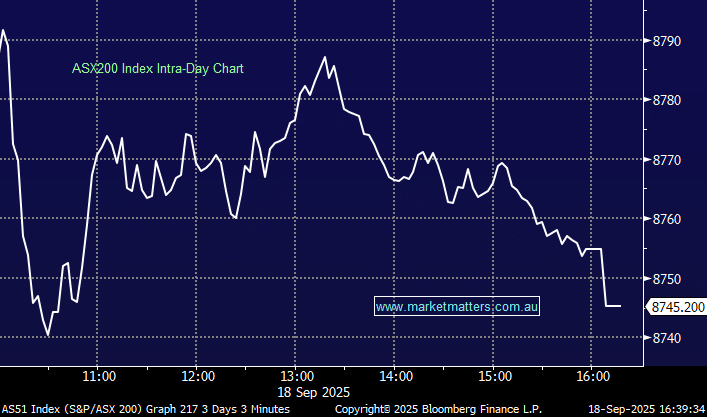

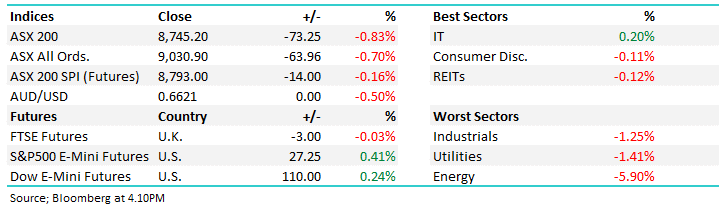

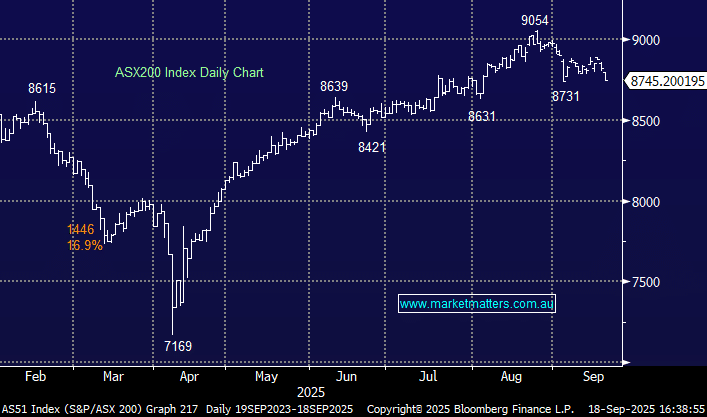

It was a weak session for the Australian share market as energy stocks collapsed following the news that Abu Dhabi National Oil Co had walked away from its $36bn bid for Santos, while a weaker than expected jobs report out at 11.30am this morning saw a rotation out of equities into safer havens, such as bonds, pushing yields lower. All ASX sectors finished in the red, bar a small gain from tech.

- The ASX200 fell -73pts/ -0.83% to close at 8745

- IT (+0.20%) the only sector in the black, while Consumer Discretionary (-0.11%) and Real Estate (-0.12%) outperformed.

- Energy (-5.9%), Utilities (-1.41%) and Industrials (-1.25%) the weakest links

- Australia’s August jobs data was soft, with employment down -5.4k (consensus +21k) and full-time jobs falling sharply. The unemployment rate held at 4.2%.

- The market is not expecting a rate cut at the next meeting on the 30th September, though the 4th November meeting is a live one, with a 90% probability of a 25bps cut priced in.

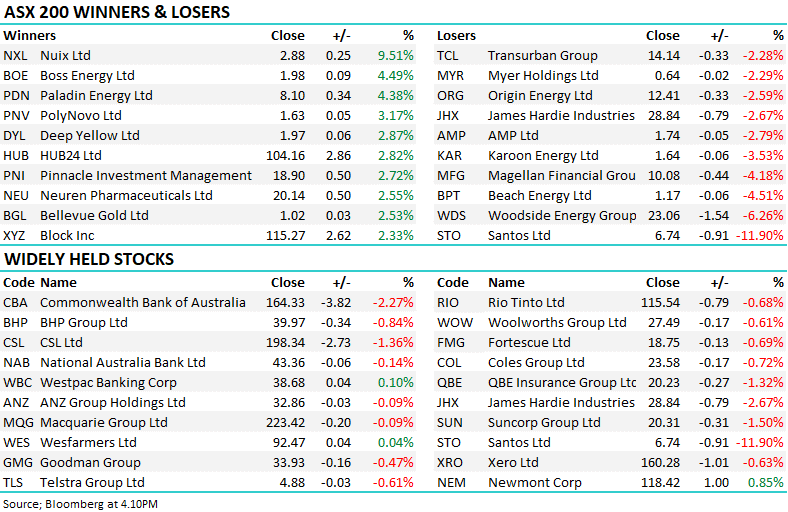

- Santos (STO) -11.9% after the Abu Dhabi takeover bid collapsed, prompting Jarden to downgrade the stock to underweight. The fallout spread across the sector with Woodside (WDS) -6.26%, Beach Energy (BPT) -4.51% and Karoon (KAR) -3.53% adding to the pain, Brent crude slipped below US$68 and WTI was trading near US$64 as traders unwound positions following the Fed’s mildly more hawkish cut.

- Nuix (NXL) +9.51% jumped on a press-release citing a new contract with German tax authorities, though nothing announced by the company itself and no details released as yet.

- Speculation emerged that Macquarie (MQG) -0.09% was in in talks to take out U.S alternative asset manager Carlyle though negotiations have come to a halt.

- Paladin (PDN) +4.38% was strong closing at $8.10, an impressive performance given they just raised $300m at $7.25. The funds are being used to expedite growth in Canada.

- Stocks with US earnings exposure came under pressure after the Fed flagged a cautious approach to further cuts. Transurban (TCL) -2.28%, Brambles (BXB) –1.61%, James Hardie (JHX) –2.67% and Ramsay (RHC) –1.85%.

- Magellan (MFG) -4.18% fell on a broker downgrade from Macquarie.

- After briefly hitting a new record of US$3707/oz on the Fed decision, gold slipped -0.8% as Powell’s comments on tariff-driven inflation firmed the USD and pressured Treasuries. Gold remains up ~40% YTD, easily outpacing equities.

- Asian markets were mixed, with Hong Kong up +1.6%, China firmed +0.4% and Japan was -0.1% lower.

- Gold traded down -$US11 during the session to $3678 around the close.

- Iron Ore in Singapore down a touch, now trading $106/mt at our close.

- US futures are trading mildly lower.