Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Some volatility on the stock level hit today, with Dominos whacked as the new CEO resigns, Helius lost another big customer and fell ~20% while UBS scattered a couple of Tom Thumbs in the wealth/funds management sector, taking a more favorable stance – a topic we’ll look at tomorrow morning. By the close, the market was back testing 8600, some 80 points above the midday low, and the bullish vibe has now hit July!

- The ASX200 rallied +56pts/+0.66% closing at 8597

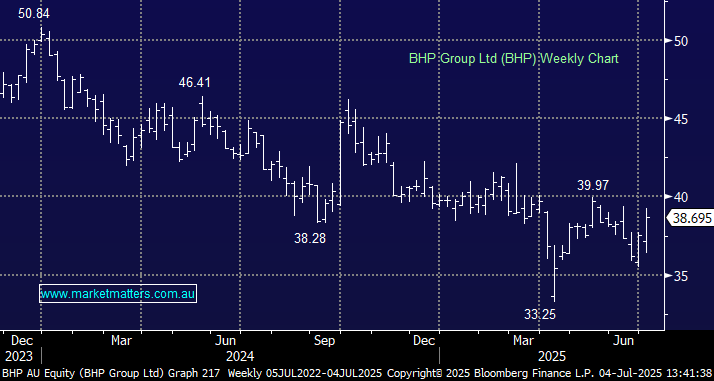

- Materials (+1.83%), Property (+1.77%) and Communications (+1.08%) led the line

- IT (-0.73%)n was the only sector that fell.

- Data @ 11.30am this morning showed retail sales rose +0.2% MoM in May, undershooting the consensus forecast for a 0.5% rise. Retail sales were only 3.3% higher than a year earlier.

- There has been volatility in recent months due to severe weather in QLD in March, as well as the impact of Black Friday and seasonal sales events from November through to January. But beneath the volatility, the retail landscape remains weak. On a six-month annualised basis, the pace of increase in sales eased to 1.8% from 2.6% in April.

- Weak retail sales are another data point that imply the RBA should be more aggressive on cutting rates – consumers are simply not opening their wallets!

- Building approvals were also weaker than expected in May, up +3.2% MoM vs estimates for +4% – another data point for the RBA.

- Helia (HLI ) -21.35% was hit hard today following news that IAG are pulling their LME contract which accounts for 17% of Gross Written Premium (GWP) – this now looks interesting again – more tomorrow

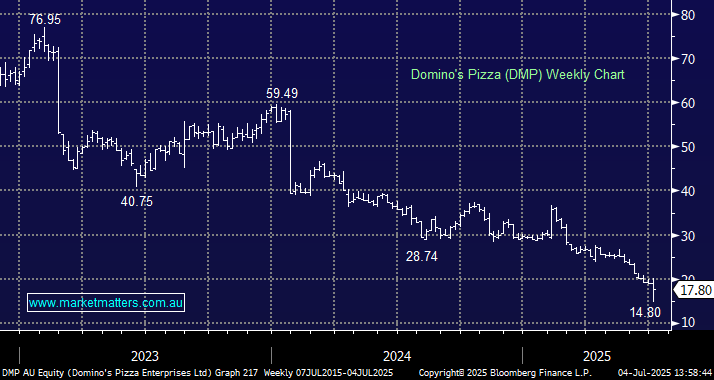

- Dominos (DMP) –15.79% was dusted with shares hitting the lowest level in over a decade, after announcing that CEO Mark van Dyck will step down, effective Dec. 23. He’s been in the role less than a year.

- Chairman Jack Cowin will assume the role of Executive Chair of DMP on an interim basis

- Big moves amongst the fund /wealth managers today as UBS takes a more positive view on the sector;

- Magellan (MFG) +5.96% was reiterated as a buy with $9.50 PT, Perpetual (PPT) +8.75% upgraded to Buy and even Platinum (PTM) +8.7% is now on a hold (from sell)

- Insignia (IFL) +1.05% flagged as their best situational play idea, an idea we wrote about recently (here)

- PEXA (PXA) -3.77% CFO has stepped down to pursue other opportunities. Deputy CFO Liz Warrell will assume the role of Acting CFO until a permanent appointment is made

- HMC Capital (HMC) -3.32% failed to bounce after yesterday’s ~18% hit – we covered our thoughts on the alternative asset manager this morning (here)

- QANTAS (QAN) -2.23% fell after announcing a cyber attack impacting 6m customers.

- Gold down $US5/oz during the session, trading around $US3334/oz at our close.

- Mixed trading in Asia, Hong Kong up +0.8%, China down -0.10% while Japan was trading off –0.3%.

- Iron Ore in Singapore rose slightly, trading at $94.50/mt around our close

- US Futures are all positive, up ~0.3%